Photo by Sandeep Singh on Unsplash

I follow a young fella on Medium.com by the name of Rocco Pendola. Rocco has a newsletter entitled “Never Retire.”

Since that’s my personal position on this unnatural concept, I was obviously intrigued when I came across his writing.

Rocco is a deep-thinking, iconoclastic, 40-something GenXer.

I like that age group. There’s a certain kind of experiential and whipsawed-based wisdom there that you don’t find in the groups before and after. I try to hang out with them as much as I can. My daughter and son are in that group. The parent-child role reversal has not happened – yet. It’s germinating. I’m learning to listen and pay more attention now while suppressing my “dad lecture” tendency they’ve endured for so long.

Nothing against my long-standing and beloved pre-boomer and older boomer inner circle. It’s just that there there’s a bit too much of a rut there, in the classic definition – a grave with the ends kicked out.

It’s not easy being weird.

There are things that Rocco advocates that I don’t line up with – inner-city rental apartment living, moving to Spain to avoid the current cultural insanity, to name a few – but his core principle of living a semi-retired life starting in your 20s or 30s really resonated with me.

In a recent post, Rocco was lamenting that he misnamed his newsletter because the name triggers friction. In his words:

“When most people think about never retiring, they take it as a negative. I probably should have called my newsletter Living the Semi-Retired Life. “

Wow, can I relate to the friction. I’ve been encountering it for a few decades on two fronts:

- Advocating for living to 100 or beyond.

- Never retiring.

The friction is greatest amongst the 70+ cohort. That space between the temples has taken on concrete block characteristics when asked to consider these ideas. Few minds get changed on these two topics at that age.

My advocacy – and Rocco’s – makes sense for the generations behind the boomers. They are more open to removing the friction that the idea of retirement creates.

What friction?

We start early creating friction with the anxiety over needing to be able to retire. It shows up in alarming intensity even amongst 20- and 30-year-olds.

I’ve been helping a master-degreed nurse executive with her career documents recently. In her 50s and on a solid career track, she recently decided to sign up to get her doctorate in nursing. Her 20-year-old son chastised her, saying she was too old to do that and that she should be focusing on planning for retirement.

Friction!

If I’m 65 and unretired, I’m considered unfortunate, a laggard – or strange.

Friction!

If I retire early, I’m a hero and am envied.

Friction!

If I speak out against the concept, I’m weird and misinformed (I’m taking a bow!).

Friction!

If I’m 50, an average saver, I wake up one day to realize I’m only about $1 million short of being able to experience that dream retirement.

Friction!

The reality behind the friction.

Lending Tree just announced that $1 million in retirement savings is no longer adequate for a “comfortable” retirement, at least in 146 metro areas.

My current domicile is one of those. The Denver Post recently reported this:

“In metro Denver, the typical retiree makes $25,504 from Social Security a year, spends $58,992 a year, which implies the need to earn $75,245 before taxes. A retirement portfolio would need to provide $49,741 to meet that demand. Following the 4% rule, a Denver area retiree would need to set aside $1,243,532 at the time of retirement.”

Let’s bounce that up against the reality of retirement saving in the U.S., as revealed in this federal report published by Edward Jones recently:

Average retirement savings by age

Source: Federal Reserve Survey of Consumer Finances, 1989-2019; https://www.federalreserve.gov/econres/scfindex.htm

Friction!

Semi-retirement is the friction antidote.

Friction suggests a lubricant. Semi-retirement is the lubricant.

Rocco and I are on the same page – just different starting points. Rocco advocates semi-retirement starting in the 20s and 30s. I suggest it for those entering late mid-life and later.

Here’s an excerpt from a recent Rocco post that describes the friction and a “practical and psychological guide to living the semi-retired life.

-

You realize you’ll Never Retire. Because, like so many Americans, you simply don’t and will never have enough money saved to quit working.

-

You fight this feeling, doubling down on the lame how to catch up on your retirement savings advice that litters the financial media.

-

You do the math. If you don’t have nearly enough saved today to retire and will most certainly be unsuccessful playing catch up, why expend the energy — physical and mental — and resources — particularly time — for a most likely futile effort?

-

You let logic overtake your emotions. You rebel against what you’ve been told and taught over the years about how to live during mid-life on the road to relative old age.

-

You start to live more evenly across the lifespan. If you’re going to fall short on retirement savings, why bust your ass? Because, if and when you fall short, you will continue to require cash flow. This is the obvious consequence of falling short — needing to continue to make money.

-

For example, at age 40, you have $100,000 (or much, much less!) saved. The chances of hitting whatever the retirement calculator spits out at you by, say, age 65, are slim. Often, they’re next to impossible.

So you slow down.

You officially become semi-retired.

My advocacy for semi-retirement amongst the 60+ cohort is more about not wasting the talent and accumulated skills and experiences on a leisure-based, purposeless lifestyle that can increase the risk of early frailty and extended morbidity.

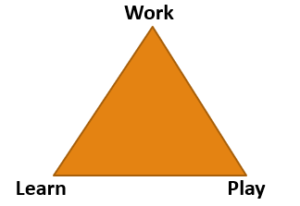

Semi-retirement in the second half or third stage presents the opportunity for a healthy balance of labor, leisure, and learning, not to mention reducing the friction that the fear of outliving your financial resources can create.

It’s unfortunate that we’ve allowed this unnatural, illogical concept to take such deep root in our culture and in our psyche.

Semi-retirement shields you from the friction, anxiety, and physical and emotional downsides that accompany retirement for many. You mix labor, leisure, and learning on a schedule determined only by you doing what you enjoy doing and perhaps even continue doing until the universe calls for the parts back.

Full-stop retirement deprives us of the opportunity to continue to contribute and create and live a healthier, longer life.

I suspect the politicians that dreamed up the idea 88 years ago didn’t give that an ounce of thought.

Leave us a comment and share your thoughts on this topic.

I’m on board! I felt an internal sigh of relief reading through your post, Gary. Semi retirement really makes sense on all aspects of the triangular approach you outline. Now I need to get busy figuring out what that could look like for me personally. Thanks for the encouragement!

Agree. We had a busy life. I was in the Reserve army for 38 years, , leader in a couple of youth groups, county and Provincial Wildlife associations, Church groups, and community organizations where we lived ,wife worked in a hospital (Secretary to the director) then office manager for a Doctor’s office, president to community organizations,a bowling club, square dance group, and did upholstering on the side.after retiring we added President to a Senior’s club that went to the county then Provincial levels, and Directors on the National. this involved traveling all around our province and later across Canada.driving, of course, which then went to Southern Georgia where a son was working, and Yellowknife NWT to visit a nephew. Camping all the way. Continuing with the upholstery, and community work.Conducting Legion Suppers and brunches for the communities fund raisers with 150 customers to suppers, and 120 to brunches on average. Great life. Remarkable senior Award from our Province.