Is Your Nose Pressed Against Reality?

At the request of a dear friend whose wife has recently been diagnosed with Alzheimer’s, I read a book entitled “Jan’s Story”. It’s a very poignant book by Barry Peterson, acclaimed CBS reporter and foreign correspondent, about a man’s journey with his wife, Jan, a victim of early-onset Alzheimer’s.

Barry coined a phrase in the book that really grabbed and stuck with me. He learned that he had to daily “press his nose against the reality” of the finality of his wife’s condition and its impact on his life and health.

The phrase resonated with me because it’s not something I do well in my own life, even dealing with issues of far less magnitude. It was a not-so-subtle reminder that I, like most, wear masks, live in denial, and avoid confronting realities in my life to escape the pressure created by facing reality. For instance, that “gap” between where I am and where I really want to be.

Unaddressed realities seem to come clearer in later life as we are forced to “press our nose” against them and make major decisions while facing a shorter horizon.

I see this frequently as I engage potential candidates regarding executive or middle-management opportunities in my recruiting business. Because most of the positions call for deep experience and expertise in a given area, I’m often reaching out to professionals who have entered the “second half” or “third stage” of their lives – likely facing fewer days ahead than behind.

I see this frequently as I engage potential candidates regarding executive or middle-management opportunities in my recruiting business. Because most of the positions call for deep experience and expertise in a given area, I’m often reaching out to professionals who have entered the “second half” or “third stage” of their lives – likely facing fewer days ahead than behind.

It doesn’t take long or too many questions to determine if a candidate is in denial about some of the realities of what lies ahead for them in this second half. Some have been granted “early, unintentional, temporary retirement” and, in some cases, are getting desperate for a job. Imminent unemployment is a reality for some as their corporate home morphs around them. Others are just restless and feeling that “stirring” called “is this all there is?”

On occasion, some of these candidates become coaching clients as the result of our dialog.

If I’m effective in my coaching relationship with them, I am able to help them “press their nose” against some unacknowledged realities.

Here are a few of the realities I see that people over 50 aren’t facing as they enter this late-life transition:

- Corporate employment is now the riskiest place to be. With a few exceptions, a company’s claim of loyalty to their employees is lip service. Given the choice between the one-time expense of a robot or piece of software and an ongoing outlay to an employee to do that work, it becomes an easy bottom-line decision. Stir in the specter of mergers or acquisitions and the inevitable “RIF’s” and the risk of not “pressing the nose” against this reality can be a tough pill to swallow for a dedicated corporate employee.

In my “reinvention” coaching, I am direct in my message that the last place to look for security today is in the corporate fold. If you are over 50 and have been downsized but intend to return to the corporate ranks, be prepared for two shocks. Unless your skills are current, exceptionally deep, and unique, you can count on: (1) an extended search, especially if self-directed (think one month for every $10k of salary); (2) your chances of duplicating your previous salary being pretty slim.

- Pace and magnitude of change. There is one guaranteed constant in life and that is change. The pace of change has never been faster and more profound than it is today, fueled by digital technology. As boomers and pre-boomers, we are particularly vulnerable to the eventuality of technology disrupting what we do.

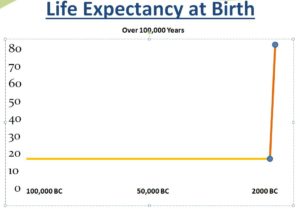

- You are (most likely) already obsolete. I recall coming across a startling statistic a couple of years ago that revealed that over 40% of college graduates never open another book after graduation. If you are over 50, you were indoctrinated with the linear-life plan I call the 20-40-20 plan that looks like this.

Learning after school didn’t go much beyond what the job required and the pace of change, until digitization arrived, was mostly modest and manageable without much skills upgrade. Today, new technologies are rapidly outstripping and obsoleting many skills and may be dropping your value in the marketplace. Gaps will be revealed quickly in the job search process. It’s imperative in today’s job market to stay current and continuously upgrade your skill set to be in step with technology developments.

Learning after school didn’t go much beyond what the job required and the pace of change, until digitization arrived, was mostly modest and manageable without much skills upgrade. Today, new technologies are rapidly outstripping and obsoleting many skills and may be dropping your value in the marketplace. Gaps will be revealed quickly in the job search process. It’s imperative in today’s job market to stay current and continuously upgrade your skill set to be in step with technology developments. - Your goals for a traditional retirement are – and should be – caput. Average retirements savings for Americans reaching the traditional retirement age of 65 is $95,776 according to the Economic Policy Institute. Healthcare cost for a couple retiring in 2016 at age 65 living to average lifespan, over and above Medicare coverage: $250-400,000 according to Nationwide Insurance. Do the math. Still, we cling to this 20th-century artifact called retirement and strive to hit a politically-driven artificial finish line to achieve something that is unnatural – pulling back, withdrawing. Then we discover that it keeps us from realizing our full life potential and robs our culture of a gold mine of talent, creativity, and wisdom. Fortunately, more and more boomers are “pressing their nose” against the reality of this failed 100-year old model and abandoning the “vocation to vacation” retirement model for one of continued contribution.

Are you at, or approaching, late mid-life and haven’t cracked a book or taken a course in the last 5-10 years that would bring your skills more in line with emerging technologies in your field? Have you “pressed your nose against the reality” of that necessity?

I’ll simply pass on the warning, as a recruiter and career coach having dealt with a number of 50+ professionals in that rut, the re-entry into employment under those conditions is a b****!

Example: An over-50 coaching client of mine was forced to “press his nose against reality” recently when he received a hard message from a recruiter he had contacted about a job that he really wanted. It was, on paper, a logical match, in the field he had been “riffed” from 10 months earlier.

The veteran recruiter laid it out succinctly and diplomatically for him: his clients won’t give him a look for two primary reasons: (1) extended unemployment with no part-time or lesser employment or volunteer work to show initiative and to maintain skills; (2) very limited skills- upgrade training in last five years of employment and no effort during his unemployment.

Fortunately, this gentleman has learned a hard lesson and landed on his feet. He has taken a somewhat risky straight commission sales position in a related field while he continues his search for his ideal position. It took moving some ego aside, but he will put himself in a role that will help him stay current, polish his skills and better position himself with employers and recruiters as his search continues.

Disruption is as given

Peter Diamandis, is an M.D. entrepreneur with degrees in molecular genetics and aerospace engineering who has started 15 different companies. In podcast #1 of a series entitled “Exponential Wisdom” that he does with Dan Sullivan of Strategic Coach (available free on I-tunes), he stated:

“Every company, every product, every service will become disrupted, obsoleted. You will either disrupt yourself or someone else will.”

Where does that leave you relative to reality as you look forward?

How susceptible is your company or industry to disruption by digital technology? And in what ways? Disruption doesn’t necessarily mean dissolution. Often it is a case of some new types of jobs being created as some are destroyed. Have you positioned yourself, educationally and politically, to move into those new roles?

How susceptible are your skills to digital disruption? Are you willing to re-don the learning hat and protect yourself against personal obsolescence?

Do some research on what professions are “safe”, if there is such a thing. Hint: my hair stylist and plumber don’t seem at all concerned.

Here’s an article posted on LinkedIn that weighs in on the subject.

What reality do you need to press your nose against? How willing are you to take the steps necessary to deal with that reality? Let me know your thoughts on this broad topic. What have you been doing to stay ahead of the disruption curve?