A Life Lesson Learned from a Thomasville Chair

2019 contained a lost summer for my wife and me. We decided to move from home-ownership to the rental world temporarily, in defiance of all conventional advice regarding balance sheet/net worth/equity/tax benefits, yada, yada, yada.

For a couple of months, we battled the remorse of leaving a large comfortable home on the 10th fairway of a semi-private golf course with this as a “backyard”:

![]() We bought the house new 19 years ago, the 10th house built in what became a 400+ home golf -course-centric subdivision. It was a nice stay.

We bought the house new 19 years ago, the 10th house built in what became a 400+ home golf -course-centric subdivision. It was a nice stay.

But we faced an expensive upgrade or go. We decided to go – let the next owners endure the inconvenience and expense.

We’ve both been surprised at how quickly we got over the remorse as we’ve finally settled into a very comfortable home 2/3 the size of the one we left.

June through August was lost to making the move, a lot of which we did on our own in the midst of one of the hottest Colorado summers on record. (Note to self: don’t EVER try that again!).

We anxiously waited for offers to come in on the house as we began the move, risking having to pay rent plus mortgage for an extended period.

We were lucky – the overlap was minimal.

We came close to catching the peak of a hot real estate market that we sensed was running its course, missing the absolute peak by about six weeks. So we did OK in maximizing our “equity capture.”

A moving experience

You’ve heard or read the stories of what it’s like to downsize, purge, declutter, etc. We are not, and never have been extravagant or major accumulators. But 49 years of marriage and family-living creates a mind-warping collection of “stuff”.

Un-stuffing is tough – and not a lot of fun.

NEWSFLASH: Nobody wants or needs your “stuff”.

Our purge was spread over 45 days of innumerable trips to Goodwill, ARC, Salvation Army along with numerous large curbside collections of “un-donatables”. Somehow we made what remained all fit into this smaller home.

It’s still way too much stuff. It’s hard to imagine another 1/3 to 1/2 downsize for our next – and likely last – move.

Did we learn anything?

This morning, in my cramped office, I found myself reflecting back on the experience and wondering: “Was there a life lesson in this drawn-out event?”

Don’t ask me to explain it, but my thoughts went to a Thomasville chair – a white-on-white, $1,200 (Y2K dollars), 4’x6’ chair-ottoman combination (the picture at the top is the real thing) that sat in our master bedroom for 19 years.

We estimate it experienced either one of our behinds less than 20 times in those 19 years! Seriously.

How hard was it to let go of emotionally? Near zero!

Was it hard to get rid of physically? Yep. No Craig’s List responses. Upscale consignment store laughed us out the front door: “Uh, 4’x6’, white-on-white? What century are you from?”

Oh, and you may already know that ARC, Salvation Army, Goodwill, et.al aren’t keen on taking furniture. We got creative at finding alternate access and dumping some lesser stuff at night.

We considered putting the chair curbside with a $50 sign on it, thus ensuring it would be stolen in the night, but our egos and a sliver of respect for our neighbors killed that idea.

So, in her perennially persistent manner, my wife found a “lesser” consignment store who agree to take it.

It went on the consignment floor for $199 with a written contract that stipulated a declining price each month along with a usurious percentage of the proceeds and the agreement that if not sold within three months, it would be given away or otherwise disposed of.

Well, surprise, surprise – it sold! On the day it hit the final reduced price on the floor – from which our proceeds were zero!

Scammed. Hoodwinked. Gullible. Hijacked. These are just a few of the words that came to me when we received the notice.

But then I rethought those retorts. What made me think I needed a $1,200 name brand chair that got sat in maybe once every six months for 19 years anyway?

You’ve come a long way – maybe!

As I looked around our current digs with its reduced footprint but still way too much “stuff”, my thoughts drifted to my maternal grandparent’s 1200 sq.ft. concrete house that they built by hand when they homesteaded in southeastern Wyoming 110 years ago (the real house pictured below).

They lived in a dugout for a year while they built the house. During much of that building year, they carried water by hand from a neighbor’s well a half-mile away as they dug their own well.

They occupied that house until they died.

They delivered four children there (one lost to scarlet fever as a teenager) and scratched out a bare subsistence on 160-acres of hardscrabble land granted them by the government to attract them to come further west from Nebraska.

I spent lots of time in that house growing up although our family lived in town ten miles away. I remember grandma pumping water by hand in her modest kitchen and cooking and baking on a coal-fired cast iron stove. Gramps was dawn to dusk, 7x, keeping animals alive and tools working and taking from the animals what they innocently relinquished.

The house was heated, quite poorly, by burning coal in a pot-belly stove in a small living room. Winters were an adventure.

Entertainment was a radio. Social life was all about church in a nearby settlement with a population of 6 by day and 4 by night – the pastor and his family of four and two grain elevator workers who showed up daily for work. The grain elevator sat by a small railroad we called BF&E – Back and Forth Empty – which it mostly was.

No indoor plumbing at my grandparent’s concrete house until 1958 (my sophomore year), the same year President Ike started building the Interstate highway through the state.

Refrigeration was an icebox that literally had a block of ice in the top and, at best, just kept things cool. But if you grow, kill, extract, or fetch most everything you eat on a near-daily basis, you don’t concern yourself much with refrigeration.

Maybe all this is at the root of my mild embarrassment over my riches.

With virtually nothing, they got along just fine. They were happy, God-fearing and dedicated family folks that never harmed a soul and helped many. They did die early, literally worn out – but at peace.

Disposal, after they were gone, didn’t involve anything resembling a 4’x6’ white-on-white unused albatross. In fact, most of their belongings, from what I can recall of them, may well have fit in that same 4’x6’ space.

So, yeah, I guess there’s a life lesson in all this. Don’t we all get there eventually?

It’s just stuff; accumulation and an eventual headache; an unhealthy attachment to the temporal; a keeping up with/ahead of the Joneses; a satisfying of a comparison complex.

Pick your psychic poison!

You’ve heard the cliché “you never see a U-haul behind a hearse”. I’m asking whoever is left of my family, should any outlast my 112.5 years, to violate that “never”. I want a small trailer to back up to my gravesite, tilt-up and slide a few items on top of my coffin: my 1966 Gibson Hummingbird guitar, my 1990-vintage Sage fly rod and my Ping putter. Oh, maybe I would include 200-300 books I’ve read that I guarantee, nobody else would bother with.

Because that’s really what I’d like to move my life to – that simplicity. I recall when my dad died at 81, everything he owned took up only a 12×12 spot in his son-in-law’s airplane hangar. I took from that modest pile his ubiquitous pocket knife, the weather barometer he looked at every day and a handful of antique carpentry tools that he had inherited from his father.

These round out the memory.

So if I ever am tempted to buy another $1,200 4’x6’ name-brand anything, I’ll simply grab Dad’s pocket knife and nick myself with it to return me to sanity and simplicity.

Thanks, Dad, for the simplicity mindset – and the antidote.

You may be more familiar with another common description of “flow”. It’s often called “being in the zone”. It’s Michael Jordan going off for the playoff record 63 points; it’s a pro-golfer shooting 59; it’s you when you become so immersed in something you love that time disappears and the work just simply flows without much effort.

You may be more familiar with another common description of “flow”. It’s often called “being in the zone”. It’s Michael Jordan going off for the playoff record 63 points; it’s a pro-golfer shooting 59; it’s you when you become so immersed in something you love that time disappears and the work just simply flows without much effort.

Let’s ignore the “OK, Boomer” fad and actively engage and listen to these youngsters with an open mind and an understanding that we need them as much as they need us.

Let’s ignore the “OK, Boomer” fad and actively engage and listen to these youngsters with an open mind and an understanding that we need them as much as they need us.

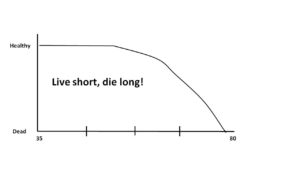

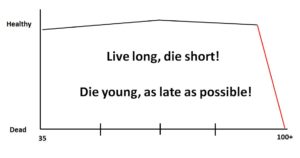

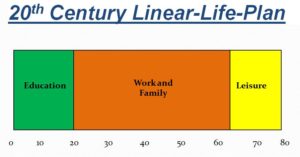

When I do reconnect with Stan, I’m going to remind him that he, like most, is operating under the model of a three-stage life (learn-earn-retire) that “taught us that this is a one-tank journey” where we may “find ourselves running on fumes as we realize it takes two tanks of fuel to propel us to a fulfilling lifelong journey.”

When I do reconnect with Stan, I’m going to remind him that he, like most, is operating under the model of a three-stage life (learn-earn-retire) that “taught us that this is a one-tank journey” where we may “find ourselves running on fumes as we realize it takes two tanks of fuel to propel us to a fulfilling lifelong journey.”