Are You “Winging It” Into Your Retirement?

“You’d Be Better Off Just Blowing Your Money: Why Retirement Planning Is Doomed.”

This intriguing statement headlined an article that came through on my LinkedIn feed this week.

I was shocked when I saw the source – Forbes.com!

Surely, with that headline, this is coming from some rogue, off-the-edge, iconoclastic, contrarian writer looking to gain a foothold in the American mind.

Kinda like what I keep bashing my head against the wall trying to do.

But to get an article with such a contrarian view published in Forbes there needs to be some street cred cooking here. Something my head-bashing is yet to produce.

Turns out there is some of all this at play here. The author is Garrett Gunderson, Chief Wealth Architect at Wealth Factory, keynote speaker, and author of the NY Times bestseller “Killing Sacred Cows.”

Wealth Factory helps entrepreneurs develop personal finance strategies that leverage their strengths as an entrepreneur.

I’m not promoting or endorsing Gunderson or his business. Well, I guess I just did a little by mentioning it. I’ve never met or talked to the man. But I think the raw truth of his article is worth mentioning.

I went to his Wealth Factor website. It’s interesting that the word “retirement” appears ONLY TWICE in the lengthy home page. In both cases, it referred to the hopeless nature of putting your money in a “retirement plan and hoping it works out.”

I really liked the article because it peels a few of the covers back on the retirement planning industry. This statement lays it out pretty straight:

“The concept of retirement has robbed the public of the responsibility and accountability required with personal finance. It has become too easy to hand money over to so-called experts due to the busyness of business, kids, hobbies, and other obligations competing for our time.”

Gunderson refers to the prevalent narrative, “work hard, save money in a retirement plan, wait and it will all work out in the long run” and calls it destructive.

It takes some real cajones to make that kind of statement considering the grip that retirement has on our collective psyche in this country. And to do it in one of the premier business mags!

It appears that Gunderson’s mission is to encourage investors – particularly entrepreneurs – to avoid the passive approach to accumulating wealth and to be more engaged and take more responsibility for the growth of their individual wealth.

What does your non-financial retirement plan look like?

As I thought about his stance against the passive retirement savings approach so prevalent in our society, it reminded me how passive we also are about planning for the non-financial side of retirement.

Much like we put money into a retirement plan and hope it works out, so many of us move into retirement without a plan, assuming the non-financial side of retirement will work out also.

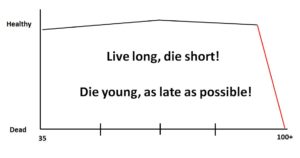

Passivity is not a good thing to have working for us for what could possibly be nearly a third of our lives.

Passivity is not a good thing to have working for us for what could possibly be nearly a third of our lives.

Consider this: if you live to be 65 without any major health challenges, you have a reasonably good chance of living to 95 or beyond. That’s a long time to drift and just “let things happen.”

But that’s what most people do.

That can be risky.

The Hartford Funds recently explored the transition into retirement and the honeymoon phase and found that 69% of new retirees have challenges adapting to retirement, 37% miss the day-to-day social interaction with co-workers, and 63% of people feel stressed about their retirement decision.

Husbands and wives often discover they aren’t on the same page about retirement, contributing to the phenomenon called “Gray divorce”. The rate of those over 50 who are divorcing has doubled in less than 30 years. Most of those divorces are initiated by the woman.

Deep depression, alcoholism, drug abuse, and suicide rates amongst the retired are alarmingly high. One of the highest suicide rates in our country today is amongst men over 65.

Those aren’t great stats for something that consumes so much of our attention and energy through the mid- to later-phases of our lives.

So what if you applied Gunderson’s advice on both sides of your retirement planning – financial and non-financial? No more passivity but rather an aggressive, take-charge position on how to build your wealth AND how you want to use it.

I spoke recently with a hospital CEO in the Chicago area that is approaching retirement. He has already let his board know that he has no more than a two-year window before stepping down. Once a major renovation of his hospital is complete, he is out of there.

I asked him about what he sees his retirement looking like. It was fuzzy at best – not uncommon even from hard-charging executive types. “Maybe a retirement community of similarly aged retirees somewhere in the southeast”, he replied.

I held my tongue since that is, in my opinion, a guaranteed fast-track to boredom and a roadblock to a purposeful third age – sort of “upscale warehousing”, if you will.

On the financial side of his retirement, however, he was anything but passive, managing his own portfolio which included investing in downtown residential real estate in Chicago. Without specifics, he made it clear that there are no financial woes in his future.

It’s a pretty typical contrast amongst execs approaching retirement: in good shape financially, limited attention to what they want their retired life to look like.

Risky and wasteful

I wish I could say that just letting your retired life happen will turn into the nirvana that the financial planning industry would have us believe it will become. There’s a chance that a happy, fulfilling, purposeful retired life will happen by chance, but it’s not likely.

The research in support of the positive impact of a purposeful retirement on longevity is extensive. Entering retirement with a plan helps avoid the loss of the early years of retirement to purposeless drifting and boredom, a common result of “winging it” into retirement.

We’re built to think, create, produce, strive, grow, learn, teach. Those are not age-specific traits. Our culture would have us believe otherwise. But we don’t have to buy it.

So Gunderson’s contrarian position applies for this third age. Take charge, be proactive, have a plan – don’t pass it off to fate or someone else’s ulterior motives.

You, those around you, and the world will be better off for it.

What your thoughts are on this? We’d love to hear from you on this topic. Leave a comment below or email me at gary@makeagingwork.com.

Also, if you haven’t, subscribe to our weekly newsletter at www.makeagingwork.com and receive a copy of my free ebook entitled “Achieve Your Full-Life Potential: Five Easy Steps to Living Longer, Healthier, and With More Purpose.”

Getting old is not the same as aging.

Getting old is not the same as aging.

There is one “what” we all know we don’t want. We don’t want our grandparents or perhaps even our parent’s retirement – isolated; park bench; bingo, bridge, and bocce ball; extended morbidity; urine-scented nursing home; walkers, wheelchairs and oxygen bottles.

There is one “what” we all know we don’t want. We don’t want our grandparents or perhaps even our parent’s retirement – isolated; park bench; bingo, bridge, and bocce ball; extended morbidity; urine-scented nursing home; walkers, wheelchairs and oxygen bottles.

Speaking of a quest, do you happen to have one for this period between middle age and true old age?

Speaking of a quest, do you happen to have one for this period between middle age and true old age?

Maybe $216,000/year just to have someone around 24×7 to feed you, clean you up and keep you on the planet is no big deal for you. But that would put you in a miniscule swath of the California population – or any state’s population, for that matter.

Maybe $216,000/year just to have someone around 24×7 to feed you, clean you up and keep you on the planet is no big deal for you. But that would put you in a miniscule swath of the California population – or any state’s population, for that matter.

Fortunately, echo and nuclear stress tests revealed that artery occlusion was minimal and blood flow was normal. But it was a wake-up call. I realized that my inattention to diet to that point had contributed insidiously to the plaque buildup in my arteries despite years of exercise.

Fortunately, echo and nuclear stress tests revealed that artery occlusion was minimal and blood flow was normal. But it was a wake-up call. I realized that my inattention to diet to that point had contributed insidiously to the plaque buildup in my arteries despite years of exercise.

“Eat food, not too much, mostly plants”.

“Eat food, not too much, mostly plants”.

When I first saw the term, I thought, yuck, a Greek sandwich made with toothpaste? But it turns out that it’s a pretty important part of your brain, specifically your hippocampus.

When I first saw the term, I thought, yuck, a Greek sandwich made with toothpaste? But it turns out that it’s a pretty important part of your brain, specifically your hippocampus.

But sneakers?

But sneakers?