Good news! Millennials Can’t Retire!!

Looks like the media and the financial planning industry is getting their knickers into knots about the prospect of millennials being unable to retire. The headline for this article from Next Avenue is certainly an attention getter: “The Bleak Retirement Outlook for Boomer’s Kids.”

If you are one who still clings to the time-worn tradition of checking out in the final third of life (aka retirement), the article will tug at you. How could one not feel sad that this vilified generation may not be able to wilt away into silent oblivion and/or an elder warehouse and instead have to find a way to keep creating and be productive.

HORRORS! What is a financial services executive or government entitlement bureaucrat to do????

Maybe these spoiled, self-centered, unloyal, independent, digital-soaked, experience-oriented brats are about to teach us something – again.

Maybe, just maybe, they aren’t gnashing their teeth and ripping their Lululemons over this because they don’t buy into the concept. Maybe they are picking up on the hysteria that surrounds this “statutory senility” or “ultimate casualty” we call traditional retirement.

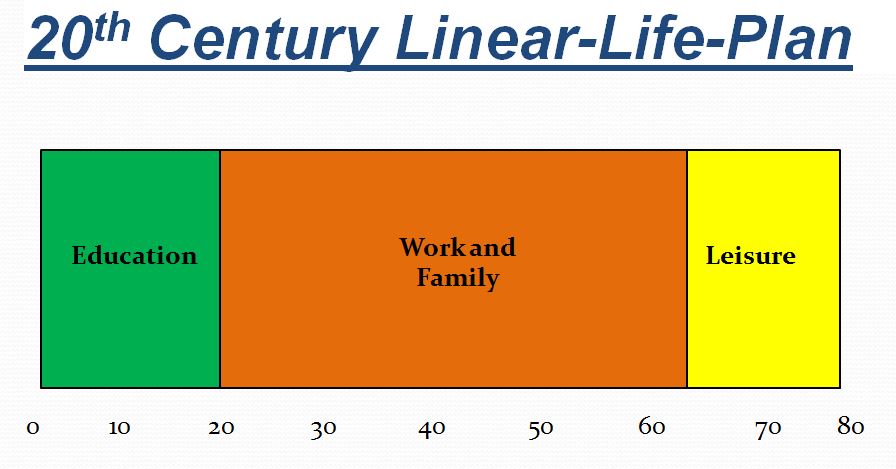

Maybe, just maybe, they’ve cast off this traditional 20-40-20 Linear Life Plan – – –

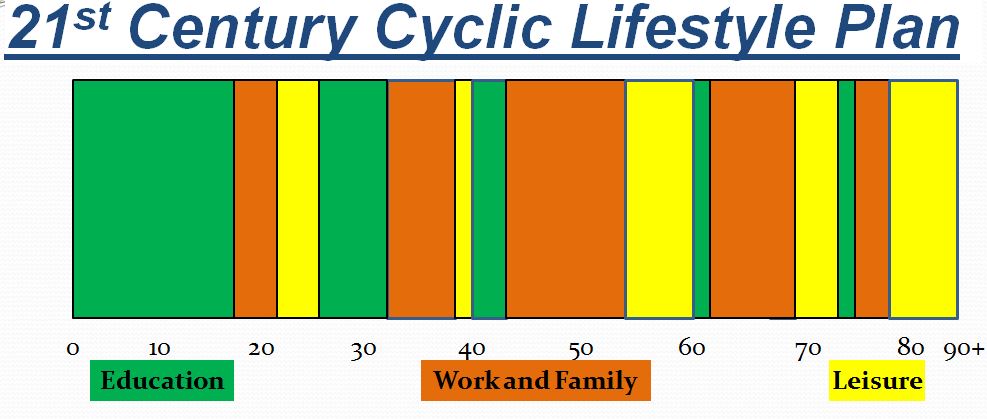

– in favor of this more sensible 21st Century Cyclic Lifestyle Plan

Source: Ken Dychtwald, Agewave.com

In last week’s blog, I wrote: “When dying people in a hospice are asked about any regrets they had about their lives, by far the most common regret is “I wish I had pursued my dreams and aspirations, and not the life others expected of me.”

I was expected to follow the 20-40-20 plan, pounded into me by parents, peers, professors, and pundits. How about you?

Maybe, just maybe, these youngers know they are facing a 75% or better chance of living to 100 or beyond and are moving forward with a more salient perspective given the prospect of a longer lifespan – one that intersperses education, work/family, and leisure across the lifespan in a more meaningful, fulfilling “experiential” way.

Maybe, just maybe, a millennial will forego saving for years to go to Machu Pichu to claim the completion of a tiring walk with achy knees and 1,000 boring pictures in favor of moving to Peru, living amongst the Peruvians for two years, learning the language and culture and bringing it home to start a restaurant featuring Peruvian cuisine. Sounds nutty to someone who drank the 20-40-20 kool-aid, I suspect. But it’s happening.

I’ll refer you to a fantastic book that deals with this very issue: “The 100-Year Life. Living and Working in an Age of Longevity.” Written by Lynda Gratton and Andrew Scott, both professors at London Business School, it was rated the Business Book of the Year in 2016 by McKinsey Corporation. Gratton and Scott combine their psychology and economics background to bring a very profound perspective to the changes that increased longevity are going to have on our society. Not the least of these changes is going to be changing attitudes toward retirement.

And none too soon, I say.

I may be completely off base

– but I don’t think so. I don’t hang with a lot of millennials so I can’t speak for them. But, as a recruiter for 18 years, I’ve experienced and heard and read a lot about how this generation’s attitudes have disrupted hiring and employee retention and development.

It seems that they want what they do to count, to have an impact, to leave a footprint for humanity. Wealth and creature comforts for many are in the back seat – at least for a while as they explore, develop and mine their self-knowledge and search for their core, driving values. If a company doesn’t line up with that evolving value system it’s bye, bye! They’re out of there – until they either find one in line with their value system or go create one themselves.

Unencumbered by a three-stage mindset, they are accepting their life as one with a longer span and multiple stages with the stages being a trail of exploration, development, and adventure with much less of the definition and predictability than we, their predecessors, find in the outdated three-stage model.

But why wouldn’t they? They saw their progenitors sell out and then be kicked in the teeth by companies; they’ve watched us push our health to the margins in favor of accumulation and image maintenance; they have low tolerance for the planet destruction associated with this image-supporting accumulation; they realize that the least safe place today to build a professional life is with a large company “working for the man” and “building somebody else’s dream.”

Maybe, just maybe they just flat don’t want to be like us.

I recently read an online post by a millennial contributor in Inc.com named Nicolas Cole and found this comment that sums it up pretty well from the millennial’s perspective:

“This is the great debate, and the issues, to be frank, go much deeper than just workplace satisfaction.”Making an impact” doesn’t mean we need to be solving world hunger on a daily basis. But I know a whole lot of Millennials that would feel a hundred times more understood if their daily tasks were acknowledged and explained as part of a bigger vision. Millennials are doers. We want to do things. And if that daily habit of doing and being involved isn’t there, then we’re going to go find somewhere else to spend our time. Because we watched our parents plug and chug their way through life, only to get to the end and say, “Don’t forget to enjoy the journey. We didn’t do that very well.”

That last sentence ought to make any financial planner sit up and take notice. I’m optimistic that today’s millennials will do just fine financially. It’s just going to be different and the money may follow a different route.

As Gratton and Scott point out, “this group is already responding to the prospect of a longer life and are keeping their options open and exploring new alternatives.” Maybe, just maybe, one of those alternatives will be to skip retirement. Maybe, just maybe, one of those choices will be to “die broke” having poured all their energy and money back into improving the human condition.

Refreshing thought – unless you are a financial planner stuck in the 20th-century mindset.

Spot on, Gary!

Thank you for inviting us to re-think traditional retirement and to look at the choices our adult children are, and will be making, differently. Keep up the great vision!

Thanks Jodie.

Hey There. I found your blog using msn. This is a really well written article. I will be sure to bookmark it and come back to read more of your useful info. Thanks for the post. I will certainly comeback.

Hello makeagingwork.com webmaster, Well done!