How to Avoid Becoming a “Bored Boomer” – Part One

A Certified Financial Planner friend of mine shared a story over breakfast recently. One of his long-standing clients – let’s call him Jack – who had fully retired six months earlier called out of the blue with a plea for help. Having entered his retirement in great financial shape, his call went something like this: “John, you’ve got to help me. I’ve got to go back to work doing something. I’m going crazy not having something important to do.”

A “Bored Boomer Retiree”

Jack appears to be another captive of an irrelevant retirement model – a casualty of an off-the-cliff leap from labor-to-leisure, vocation-to-vacation. An emerging rebel against the archaic, politically-inspired artificial finish line called traditional retirement.

Seventy-eight million strong and hitting this artificial finish line of 65 at the rate of 10,000 per day, Boomers everywhere are beginning to discover that retirement, as we’ve known it for decades, needs redefining.

A 2016 Federal Reserve Study revealed that a full 1/3 of retirees eventually reconsider retirement and return to work on either a full or part-time basis.

Another study published in 2019 by the Rand Corporation revealed that 39% of workers 65 or older who were currently employed had retired for a period but decided to return to the workplace for more of their “golden years.

A share of this trend can be attributed to the fact that 2 of 3 retirees enter retirement having given little or no thought to the non-financial components of retirement life only to discover that those “soft side” elements play a much larger role in retirement than the “hard-side” financial elements where the major planning effort is focused leading up to retirement.

Unfortunately, this discovery often comes later than it should. Much of early, prime-time retirement is wasted as a result of this lack of non-financial planning. New retirees typically experience a 1-5 year ”retirement honeymoon” period, during which the mental, social, physical, and spiritual challenges emerge that were never discussed or planned for in the offices of their financial planner.

Issues such as:

- Overcoming a loss of identity.

- Divergent post-retirement interests between spouses.

- Boredom due to lack of challenge and social engagement.

- Depression and physical deterioration because of reduced activity and social interaction and lack of a sense of purpose.

NOTE: My 5/14/18 blog provides additional insight into the dark side elements of retirement.

How do you avoid becoming a “bored boomer?” A three-part series.

This article is the first of a three-article series on this topic, each with three suggestions for avoiding this plight. You don’t have to be retired to consider these. In fact, considering them at the pre-retirement stage will bring even more benefits.

Suggestion #1: Unmuzzle your “essential self”.

What was your 6-, 8-, or 10-year-old-self good at, passionate about, naturally drawn to, and undeterred in pursuing before parents, peers, professors, politicians, and pundits tamped it all down and out? There are clues to your essential self in all of that.

In her seminal book “Finding Your Own North Star, Claiming the Life You Were Meant to Live”, Martha Beck reminds us that most are “- – responsible citizens who have muzzled their essential selves in order to do what they believe is the ‘right thing’”.

For most of us that “right thing” has been 30-40 years of “cubicle nation” building someone else’s dream believing that a fuzzily-defined, nirvanic, rewarding escape waiting at the end will be worth it.

For some, the “right thing” is in step with the “essential self” – for most, not so much. Why else would we covet getting away from it and “give up” or “withdraw”? Which, by the way, is the definition of “retire.”

When the “right thing” goes away or morphs into that “rewarding escape”, we can find ourselves face-to-face with that uncomfortable question: “Who am I and why am I here?”

There it is – the perfect mental launching pad for resurrecting what really lit you up before social expectations locked you down.

I’m slower than most.

I chased the “right thing” across four different industries for over three decades and traveled deep into my sixties before finally unmuzzling my essential self and honoring my bent toward writing and teaching/coaching.

A couple of retired friends of mine are integrating their essential selves, passions, and their natural and acquired skills and leveraging them back into the marketplace where they will continue to do good.

For a recently retired hospital CEO in Missouri, it is choosing to broaden and deepen his passion for civic and community involvement through board-level positions to pay forward his executive administrative experience as well as satisfy a passion to serve. To satisfy another passion, he builds and refurbishes black-powder, muzzle-loader rifles.

For a retired nurse executive friend, it’s taking her doctorate in nursing and decades of top-level nurse management experience back into the marketplace to help nurses cope with the pressures of today’s broken healthcare system and be more caring patient advocates. She’s doing it through a childhood passion for writing and teaching, using the internet, social media, and book publishing.

Suggestion #2: Reintegrate yourself

I was tempted to suggest “reinvent” instead of “reintegrate.” The idea of reinvention is omnipresent these days, especially in the self-help world and particularly when it comes to those of us in the second half of life. Retirement itself has become a deserving target of reinvention.

I was persuaded to reject reinvention in favor of reintegration after considering the position taken on this by Marc Freedman, CEO and President of Encore.org and one of the nation’s leading experts on the longevity revolution. In a Harvard Business Review article “The Dangerous Myth of Reinvention” Freedman makes the point that reinvention is too daunting and not practical because it infers discarding accumulated life experience and starting over from scratch.

Freedman makes a very valid point in the article:

“Isn’t there something to be said for racking up decades of know-how and lessons, from failures as well as triumphs? Shouldn’t we aspire to build on that wisdom and understanding?

After years studying social innovators in the second half of life — individuals who have done their greatest work after 50 —I’m convinced the most powerful pattern that emerges from their stories can be described as reintegration, not reinvention. These successful late-blooming entrepreneurs weave together accumulated knowledge with creativity, while balancing continuity with change, in crafting a new idea that’s almost always deeply rooted in earlier chapters and activities.”

Reintegration dovetails nicely with point #1 above. Combining accumulated skills and life experiences with a forgotten or long-suppressed passion won’t give boredom a foothold. And it lifts away the intimidating idea of a reinvention.

More and more Boomers are finding this to be a path to an energizing, inspirational second career in which income, new meaning and contribution and service intersect.

Suggestion #3: Start a lifestyle business

Can you imagine a greater boredom antidote than taking #1 and #2 above and putting them together into a lifestyle business?

What is a lifestyle business? Three components:

- A level of income that you desire in your life.

- Time freedom. Work when you want, as much as you want.

- Location independence.

But wait, I’ve busted my hump for 40 years to get away from business. Plus starting a business at any age is too risky.

Well, let me take some air out of this instinctive negative reaction.

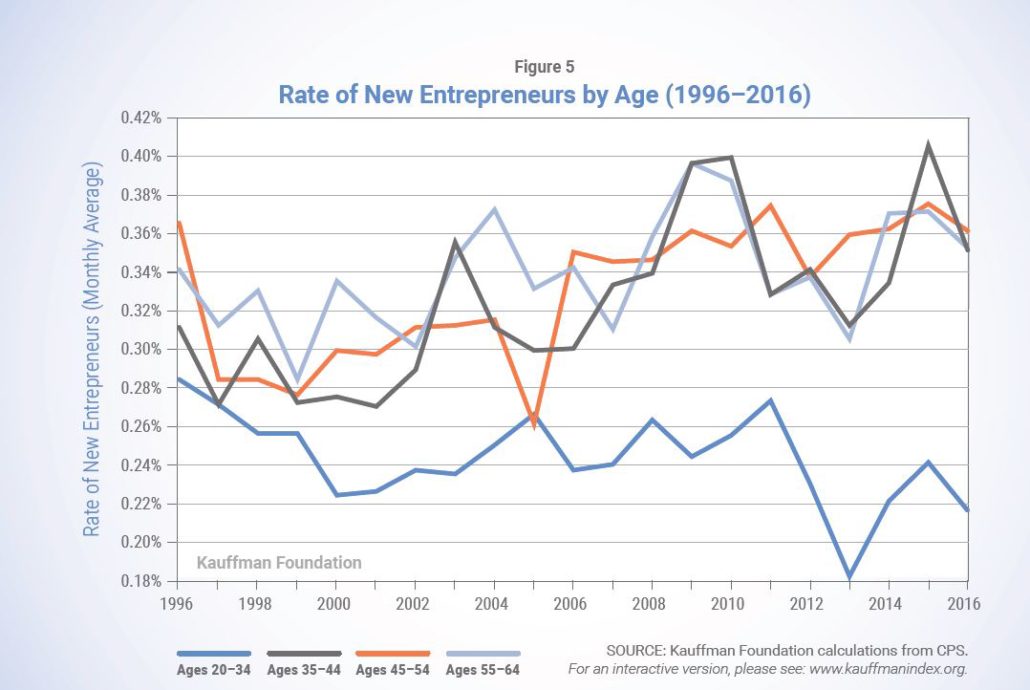

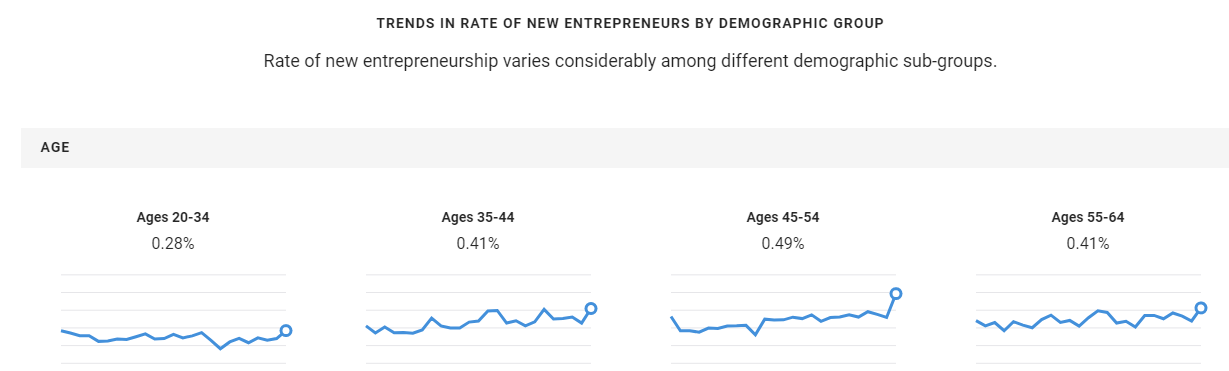

In 2016, new entrepreneurs 55-64 swelled to over 25% of new businesses started according to the Kauffman Index of Entrepreneurship. Check out these two Kaufmann graphs and note how over 50% of business startups happened by Boomers

Those figures didn’t change much in 2020:

Source: https://indicators.kauffman.org/indicator/rate-of-new-entrepreneurs

And according to the U.S. Bureau of Labor Statistics report, Self-Employment in the U.S., the self-employment rate among workers 65 and older (who don’t incorporate) is the highest of any age group in America: 15.5 percent. In sharp contrast, it’s 4.1 percent for ages 25 to 34.

Consider this: Boomers with experience have an entrepreneurial edge in today’s knowledge-based economy. And start-up costs and risk levels have been mitigated like never before by digital technology.

Still skeptical? Here’s a Youtube video by Miles Beckler, internet marketing and entrepreneurship guru (an apparent Gen X’er) with ten ideas for lifestyle businesses just to prime your thinking pump.

I’ll list them here in case you aren’t into Youtube or just want the cliff notes. Go to his video for details.

- Information products

- Become an author

- Affiliate marketing

- Print on demand (t-shirts, fine art, coffee mugs, a virtual store with no inventory, photography/online gallery, etc.). Pairs well with F-B marketing

- Selling services – WordPress training, hosting, web design, graphics services, copywriting, etc.

- Drop shipping – selling other people’s products without owning inventory

- FBA – fulfillment by Amazon. You find products send them to Amazon and they do the fulfillment.

- Coaching and consulting

- Selling advertising

- SAAS (software as a service )

This list barely scratches the surface of the types of businesses being started by enterprising – and formerly bored – boomers.

Stay tuned. Next week, we’ll jump into three more tactics to save ourselves from Boomer Boredom.

How have you avoided Boomer Boredom? Would love to hear about what’s kept you out of that abyss. Scroll down and leave a comment or email me at gary@makeagingwork.com.

Don’t forget the free e-book “Launching Your Full-life Potential” available when you subscribe to this weekly newsletter at www.makeagingwork.com.

Wow, Wow, and Wow.

You painted the picture exceptionally well…inspiring and informative.

Good job!

Thanks, Pat

Good morning!

A great article — congratulations!

I retired 5 years ago — I was 63 — from a career in communications. My wife continued to work so I had the house to myself!

Right away I began my second act: as a humour (I’m Canadian!) writer. Every Monday morning my weekly column called ‘Living Retired’ directed to baby boomers was sent by email. Today over 3,000 people read ‘Living Retired.’ Before I knew it I had a website (www.LivingRetired.press) and was being invited to give speeches (‘I Don’t Have Wrinkles, I Have Laugh Lines’).

But then, a year ago my wife retired and our mothers (97 and 95) suffered serious health issues that required our attention. Thankfully they are doing better but for an entire year I had to forgo writing ‘Living Retired.’

So just as things settled down caring for our mothers, my wife took on a fulltime 2-year contract position at a nearby university (I have the house all by myself during the day again!) and I am about to return to writing my weekly humour column.

But wouldn’t you know it!

The new CEO of the hospital system I retired from reached out and presently we are negotiating me providing strategic communication assistance for him.

Retirement life changes — and from my experience retirement boredom can ebb and flow.

Looking forward to your continuing columns on this phenomenon.

Cheers!

Gary Chalk.

Gary, thanks for your kind comments. I appreciate your feedback on my posts. I’ve laughed my way through several of your posts on your site – you are truly a very funny, talented writer. I hope you can return to publishing more articles some day.

I left the computer industry to milk cows & make cheese. You need to be very careful about starting a new business if you have been a serial entrepreneur. I found myself back in another rat race just a different maze.

Thanks for the comment Terry. I hope the fact that it’s YOUR rat race and not one created by somebody else makes it more palatable.

I really do appreciate your observations, insights and ideas. But, honestly, none of these things even remotely are my experience. I retired as an executive with the Walt Disney Company in 2017. I’m 69 years old, in pretty good shape, set financially and have enough interests to keep me going until I leave this life. I can’t remember ever being bored…seriously. I read Younger Next Year. The idea of ‘ your job is to stay in shape’ resonated with me. I’m up at 5 AM. I go to a ‘spiritual’ meeting for an hour 7-8 AM 5 days a week when we’re not traveling. I work out at least 2 hours a day 5 days a week. I write for the Good Men Project sometimes, as well as fiction. I’m a mentor to young executives and consult on occasion for fire departments and meteorologists (two passions). I could care less whether I’m paid but I usually am.

I speak Russian, German and Hebrew with talking buddies in those countries by Skype. I have two amazing adult kids and grandchildren.

Here’s the point: I don’t need anything. I don’t need to prove that I still matter through a job. I’ve worked my ass off for 40 years. I’m not going to go do it again to prove what?! The day I walked out of my retirement party my stress level went to zero. I had a great career in two industries and I’m never looking back.

The very last thing I need is a ‘retirement coach.’ I’m sure some people do. God bless them and you. I think I’ll just keep being my own coach. It’s worked well so far. My very best to you, pal.

Thanks for you input, Ben. Unlike most who move into retirement, you seem to be proceeding with a sense of purpose built around deep interests and a commitment to service. I find most folks don’t enter their post-career life with much of a plan. Most people don’t perceive a need for a “retirement coach”. I’m not fond of the term myself and am more interested in working with people as a life-design coach and health navigator with a focus on helping them find the path similar to yours i.e. carrying your skills and experience forward and helping others. Glad you found value in Younger Next Year. Good to hear from you. I welcome your input and insight going forward. It’s very helpful.

Website promotion is inexpensive with a quality guarantee, hurry up !! http://www.links-for.site

widow dating widower

dating services online

Connect Abroad Corporation

purim 60 capsicum purim 60 capsicum

Questions

먹튀검증

факты про водолея

Суп-пюре из шампиньонов со сливками – 8 рецептов грибного крем-супа

https://dks-septiki.ru/uslugi/kanalizaciya-dlya-bani-i-sauny-na-zagorodnom-uchastke-na-dache/

jav harem

https://seasonvar.site/

https://kinogo-hd.site/

https://www.e-akb.ru/akkumulyatory/tyagovye-akkumulyatory-dlya-pogruzchikov-i-skladskoj-tekhniki/akkumulyatornye-batarei-dlya-pogruzchikov-xilin

https://sokolov-design.com/

https://loyalen.com/

отзывы master-na-100.ru

https://koreacars.me/

Heya! I’m att work surfing around your blog from mmy new iphone

4! Just anted to saay I love rading your blog and look

forward to all your posts! Keeep upp thhe excrllent work!

операция на крестообразных связках…

светящиеся буквы видное

https://plisio.net/accept-trueusd

шенгенская виза в испанию

внж в оаэ при открытии фирмы

чугунные банные чугунные печи для бани

купить мебельное производство

dreambook

what to give

https://clean-reshenie.ru/

Сверла с коническим хвостовиком

tasty recipes

university

how to boil

https://seosait.com/obzor-konstruktora-meta-tegi-onlajn/

It’s perfect time to make a few plans for the long

run and it’s time to be happy. I’ve read this publish and if I may

I desire to recommend you few interesting things or suggestions.

Maybe you could write subsequent articles relating to this article.

I desire to read even more things about it!

No matter if some one searches for his required thing, therefore he/she needs to be available

that in detail, therefore that thing is maintained over here.

Feel free to visit my page :: tracfone special coupon 2022

online beatmaker

https://www.pinterest.com.au/pin/1125125919383036460/

оборудование металлургической промышленности

If some one wishes to be updated with latest technologies after that he must

be pay a visit this site and be up to date

daily.

Here is my homepage tracfone special coupon 2022

anycubic

отделка дома сайдингом

продажа грузовой техники

заказать поздравление с Днем Рождения по мобильному телефону https://na-telefon.biz/

Дизайнерские светильники – купить эксклюзивное интерьерное освещение https://ru.mai-he-mai.com/partner/partner/31/

Интернет магазин светильников и люстр https://ru.mai-he-mai.com/partner/partner/31/

приставки playstation 4

Hello, I enjoy readiung all off yor post. I lik to

write a little comment too support you.

ворота ковка

купить гриль, грили

поверка счетчиков в наро-фоминске

Register and take part in the drawing, click here

фонари уличного освещения

поверка счетчиков наро-фоминск

download steam authenticator

steam desktop authenticator pc

steam authenticator pc

I like what you guys are up also. Such intelligent work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it will improve the value of my web site 🙂

Эвакуатор Люберцы

https://fashioninsider.ru/fashion/s-kakimi-cvetami-socetaetsa-korallovyj-cvet-idei-obrazy-foto.html

To the makeagingwork.com owner, Keep up the great work!

Hi makeagingwork.com admin, Thanks for sharing your thoughts!

steam guard desktop

установка алмазного бурения купить

Register and take part in the drawing, click here

1win Г© confiГЎvel

steam authenticator

Dear makeagingwork.com webmaster, Your posts are always informative and well-explained.

https://t.me/autodvizhh

Thanks for sharing excellent informations. Your web-site is very cool. I am impressed by the details that you have on this site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched all over the place and simply couldn’t come across. What an ideal site.

To the makeagingwork.com owner, Your posts are always well-cited and reliable.

затирка уфа

To the makeagingwork.com administrator, Thanks for the well-structured and well-presented post!

поверка счетчиков балабаново

поверка счетчиков малоярославец

Новый портал знакомств TimLike

https://vk.com/vozdushnyesharikivmoskve

https://108waystohappiness.com/healing/kambo/

поверка счетчиков воды обнинск

поверка счетчиков белоусово

Dear makeagingwork.com webmaster, Thanks for the educational content!

поверка счетчиков воды ермолино

поверка счетчиков воды жуков

поверка счетчиков воды боровск

https://promocash.pro/ru/shops

insandv

тахта на заказ

Hello makeagingwork.com administrator, You always provide helpful information.

Hi makeagingwork.com admin, You always provide practical solutions and recommendations.

Dear makeagingwork.com webmaster, Your posts are always well-structured and logical.

Dear makeagingwork.com administrator, Your posts are always well received by the community.

Hi makeagingwork.com owner, You always provide clear explanations and definitions.