Your Second Half Should Be Filled with These Four-letter Words

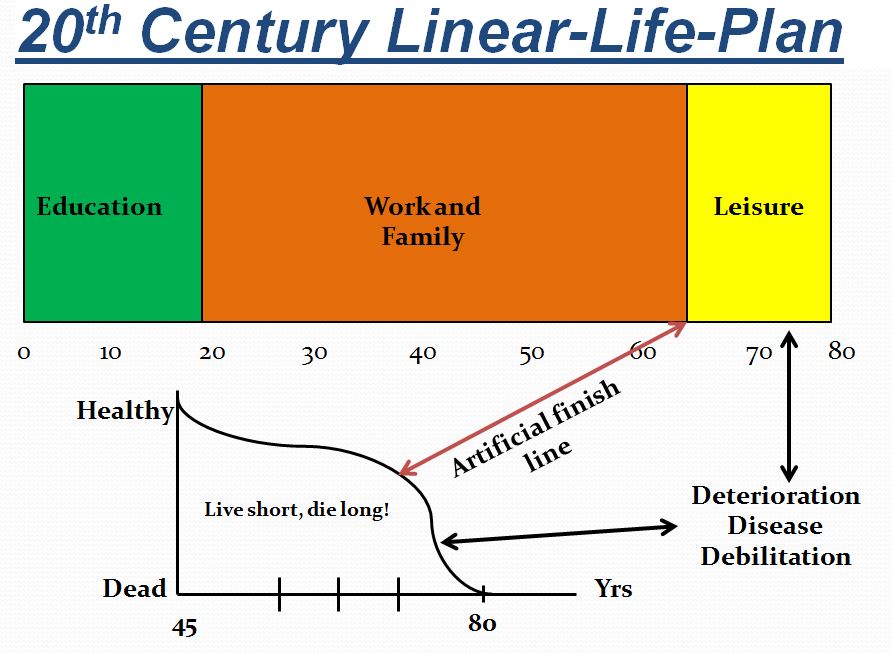

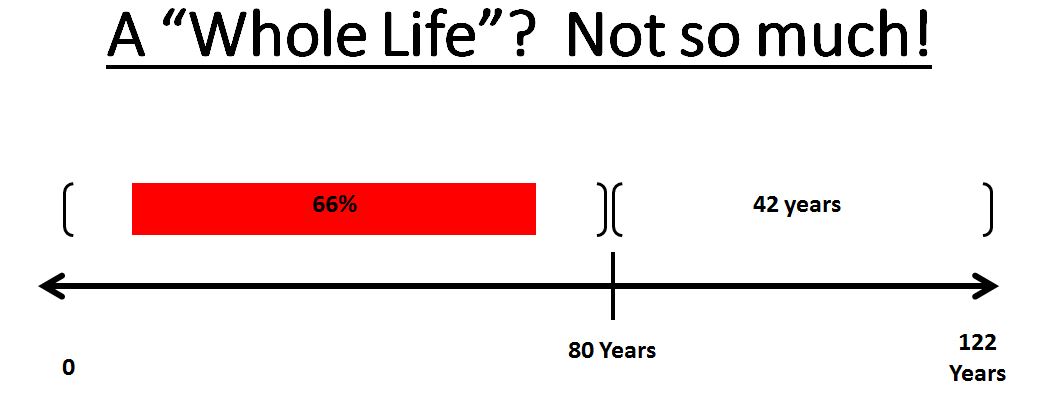

The second half of life (I’ll optimistically call it the 50-to-100 phase) is rife with both opportunity and challenge.

It’s a time when social expectations expect us to begin to “wind down” rather than “rewind”; to “land” and not “take off”; to retire and not rewire; to retreat and not advance.

It’s a time often referred to with four-letter words like slow, idle, aged, gray, shot, worn, gone, beat, done.

I suggest we boomers and pre-boomers replace those with more appropriate four-letter words. Here are fifteen to fold into your thinking and vocabulary to overpower the aforementioned:

Work

Work keeps us alive. We abandon work at our own peril. A study of 83,000 Americans 65 and older published in Preventing Chronic Disease, a publication of the U.S. Centers for Disease Control and Prevention, found that being unemployed or retired was associated with the greatest risk of poor health.

Plan

Retirement can mean getting away from the planning, discipline, and routine that made us successful during our careers. Why is our later life undeserving of working from a plan, especially when we bring forward so many acquired skills and wisdom? Find your “essential self”, uncover your deepest passion and put together a plan to put both to work.

Meet

One of the threats to longevity and good health in the second half is social isolation. Don’t let your social network atrophy. After retirement, we expect that we will be able to maintain meaningful relationships with former co-workers. That rarely happens. It’s vital to replenish those connections with new relationships that are uplifting, stimulating and supportive.

Jim Rohn, entrepreneur, author, and motivational speaker, reminds us of the vitality of our closest connections:: “You are the average of the five people you spend the most time with.”

According to AARP, social isolation is as deadly as smoking 15 cigarettes a day ( see this blog).

Seek

Continue to seek wisdom and knowledge and new experiences. The brain is a muscle and will atrophy just like any other muscle. Push the envelope on new experiences and force yourself out of your comfort zone, which will magnify as you move into retirement. Never stop learning.

Give

Deep down, we are wired to serve. These later years are an opportunity to be deeply grateful and to pay forward what we learned and earned.

Muse

Seek a source of inspiration. Whether its meditation or prayer, finding a way to connect to the higher power that is the source of all energy, creativity, and imagination is fundamental to maintaining vitality and sense of purpose in the second half.

Move

As in exercise. A sedentary lifestyle is a major contributor to poor health in the second half. Keep moving. Replace the LazyBoy with a treadmill and the TV with yoga lessons. Oxygenate your cells every day with an aerobic exercise of some form.

Lift

In two ways: (1) lift others up through example, engagement and encouragement and (2) lift weights to maintain good health. The late Dr. Henry Lodge said it well in the bestseller “Younger Next Year”: “Aerobic exercise will give you life, strength training will make it worth living.”

Love

It still makes the world go ‘round. And that love should include – actually start with – loving yourself.

Task

Have a challenging task facing you each day. Take on something scary, something you’ve never tried before. Have something that stretches you mentally and physically. Task yourself with challenging goals and projects focused on paying forward your wisdom, acquired skills and passion.

Idea

Creativity doesn’t die with age unless we allow it. Idea creation is a great way to keep our cognitive abilities alive and well. That lifetime of experience is a great petri dish for developing new ways to do things. What can you create that would benefit others drawing from your experiences, your passions and your core skills/essential self? Just know that when you do this, you rebuild and add new neuronal connections and contribute to your brain health.

Zeal/zing/zest

Don’t be a “geezer” or a “hag.” Add zeal, zest, and zing to your persona. Don’t act your age. Dress young. Break the rules for someone your age. Make people want to know what you are up to because your attitude, your appearance, and actions are so far outside “convention” for someone in your demographic. See elan below.

Lead

Somebody somewhere needs your help to lead them out of some form of darkness, be it in life, business, health, relationships. Be available. Be necessary to somebody. Pay forward what you’ve learned.

Star

Be one by helping others shoot for theirs.

Elan

These synonyms say it all: flair, style, panache, confidence, dash, energy, vigor, vitality, liveliness, brio, esprit, animation, vivacity, zest, verve, spirit, pep, sparkle, enthusiasm, gusto, eagerness, feeling, fire, pizzazz, zing, zip, vim, oomph. These aren’t typically used to describe someone in their later years – but you are an exception!

This quote from author Lillian E. Troll is a fitting end to our list:

“To be young is to be fresh, lively, eager, quick to learn; to be mature is to be done, complete, sedate, tired. What if we consider a different perspective: To be young is to be unripe, unfinished, raw, awkward, unskilled, inept; to be mature is to be ready, whole, adept, wise. How valid are our glorification of youth and our shame about having lived many years? Lillian E. Troll

Scroll down and leave us a comment – or your own favorite, positive four-letter word.

You can subscribe to our weekly newsletter at www.makeagingwork.com and receive a free e-book “Achieving Your Full-life Potential” as a thank you.

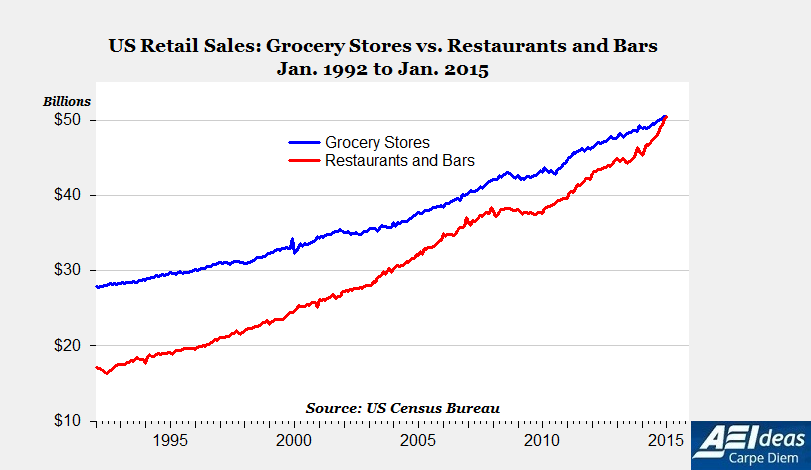

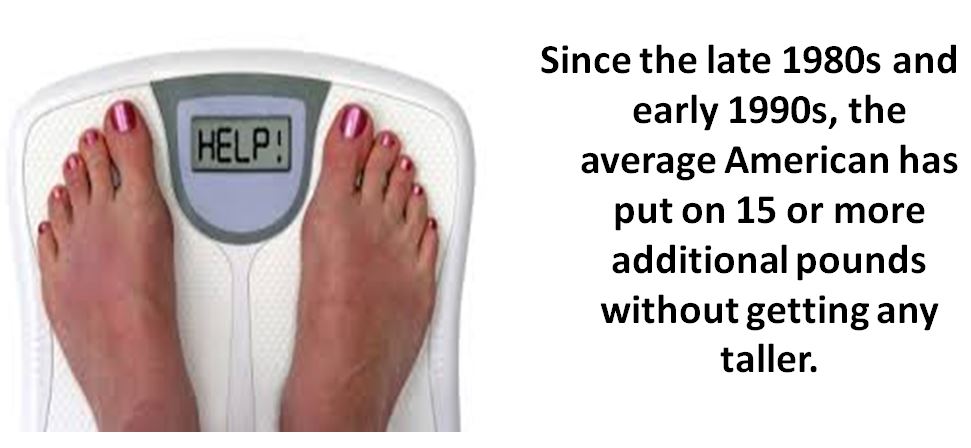

Pollan refers to the research that the industry does to determine and then feed our “craveabilty”. We know it centers around clever manipulation of sugar, salt and fat. Once we are hooked on that deadly combination, so cleverly baked (pun, yes) into processed foods, it’s hard to break away.

Pollan refers to the research that the industry does to determine and then feed our “craveabilty”. We know it centers around clever manipulation of sugar, salt and fat. Once we are hooked on that deadly combination, so cleverly baked (pun, yes) into processed foods, it’s hard to break away.

But, don’t do what I did – please! Don’t wait for some health scare before you educate yourself and adopt better eating and other health habits. Begin now to exercise “self-efficacy” and take control of your health and become knowledgeable how your body works and what it takes to make it work optimally. And, if possible, get on the same page with your spouse or partner on what is good for you. If that won’t work, take charge and become your own gatekeeper.

But, don’t do what I did – please! Don’t wait for some health scare before you educate yourself and adopt better eating and other health habits. Begin now to exercise “self-efficacy” and take control of your health and become knowledgeable how your body works and what it takes to make it work optimally. And, if possible, get on the same page with your spouse or partner on what is good for you. If that won’t work, take charge and become your own gatekeeper.

It’s a tough journey, this self-discovery trip.

It’s a tough journey, this self-discovery trip.

So, as I write, I’m a confessing “bad-ass, obnoxious, sarcastic, audacious-ager” intent on sliding home at 100 or later like Pete Rose slid into second! My ”fearful and wonderful life within” means I have a voice and the messy story that has been my life is my message, warts and all.

So, as I write, I’m a confessing “bad-ass, obnoxious, sarcastic, audacious-ager” intent on sliding home at 100 or later like Pete Rose slid into second! My ”fearful and wonderful life within” means I have a voice and the messy story that has been my life is my message, warts and all.

The date arrives. Jubilation! Liberation!

The date arrives. Jubilation! Liberation! :

:

Words count.

Words count.

Look’s point with the article has to do with the importance of, in his words, “pushing the boundaries and seeking new horizons to achieve a fulfilling retirement.” In addition to the Himalayas and eating a beating cobra’s heart, his activities have included things such as swimming with whale sharks, running the London marathon, rescuing street dogs from the meat trade in Thailand and living for a time on the Mekong River in Laos.

Look’s point with the article has to do with the importance of, in his words, “pushing the boundaries and seeking new horizons to achieve a fulfilling retirement.” In addition to the Himalayas and eating a beating cobra’s heart, his activities have included things such as swimming with whale sharks, running the London marathon, rescuing street dogs from the meat trade in Thailand and living for a time on the Mekong River in Laos.