Does Your Retirement Have an Endurance Quotient? Pay Attention to the Millennials.

Endurance quotient? Hmmm. Whassat?

Merriam Webster: endure = last, persist.

Remember back in your 40s, 50s (maybe even 60s for you slow-to-awaken, like yours truly) when those “legacy” thoughts made their uncomfortable, uninvited entrance into your thought stream, sometimes intensified as engagement with the grape deepened.

Like:

- Why am I here?

- Is this all there is?

- Oh s**t! I’ve got fewer days ahead than behind.

- Why haven’t I gotten to where I thought I’d be at this point or where culture says I should be (this is called “shoulding on yourself” – common at this mid-point).

All thoughts that bring us face-to-face with the question of how we are going to endure in our second half/third-age/post-career life.

We should deal with these purposefully and not just default to the prevailing path of no resistance: done at 65, wind down, kick back, hop on the accelerating downslope of declining health and lack of purpose, and forget about anything resembling a legacy – thinking it’s too complicated and takes too much thought and energy.

Don’t go there. It’s too important.

Maybe we can learn from the millennials!

Once we stop throwing rocks at the millennials and early GenXers, we may notice something worthy of our attention when it comes to a new, different, and healthier lifestyle and perspective on retirement.

I recently came across a GenX writer on Medium.com who I feel is saying some things about retirement that we Boomers and pre-boomers need to pay attention to.

Rocco Pendola is a Californian whose byline on Medium.com says: “I write about doing life and personal finance, focusing on the psychology of our relationships with other people and money. I’m anti-guru, pro-empowerment.”

An iconoclast – my kinda guy!

One of his recent posts entitled “Retiring at Age 61 Might Be This Year’s Most Depressing Thought. There’s a better way than what the investing establishment sells.”

It’s a worthy read. In it, Rocco excoriates the financial services industry and the media for not reporting what is really going on in the GenX and Millennial world. And he introduces a taste of the emerging mindset that this group is beginning to demonstrate.

Here’s an extract from the article for you to ponder:

They don’t tell you about the movement of young people reconsidering the entire concept of traditional retirement (credit the media for starting to finally cover this!). They don’t talk about young people living a semi-retired lifestyle, which means different things to different people, but almost always includes some form of work for the duration.

As I wrote earlier this year, the millennial generation does things differently than those who came before them, particularly the upper end of Generation X and certainly many baby boomers.

They:

- Focus on… physical health.

- Focus on securing consistent work that endures. That you can do if you find yourself physically unhealthy.

- Focus on… mental health.

- Focus on… the mindset to do work that endures for eternity.

- Focus on finding a partner who lives simply but likes nice things. Who you can just be with. Every outing isn’t a trip to Rome. But, if you’re lucky, you can make something like that happen one or more times per year.

- Focus on cash flow.

- Focus on allocating that cash flow amid an insanely low cost of living as to have cash surpluses every month.

These things comprise the cornerstones of the move away from conventional retirement and toward the much more realistic, hopeful, vibrant, and life-affirming concept of semi-retirement.

If you’ve done the math and don’t think you can “retire” until you’re 61, please reconsider.

There might not be a more depressing thought, assuming you buy into what the word “retire” has always meant. That you work a job you don’t necessarily like all that much, live a little along the way, and set yourself up to really live when you’re really, really old and probably won’t be able to live all that well anyway.

The road to traditional retirement can beat you down.

Living the semi-retired life means you don’t stress yourself out over having to meet some out-sized number by the time you’re sixty-something.

It also means you set yourself up for healthier old age by making your physical and mental health a priority — not the 9-to-5 grind — when you’re young.

OUCH!

Tough words for all of us 20th-century “retirement relics!”

Semi-retire at 35? Heresy!

Work until you die – at something you’ve learned to be good at and that you like and helps fix this messy world? I don’t think that line will fall from the lips of a financial planner.

Think cash flow? And an insanely low cost of living? How’s that gonna go down in a “consumption is king” culture?

Consistent work that endures? Work that you can do if you find yourself physically unhealthy? That four-letter word is supposed to end on or about 65, isn’t it?

They’re reading different manuals!

Maybe we need to subscribe.

For sure, we need to pay attention. This is going to be the model.

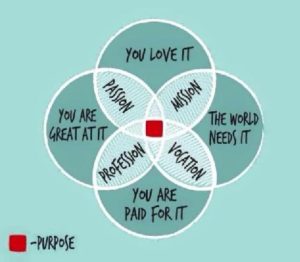

I relate because I’ve considered myself semi-retired for some time as I’ve sought that purpose sweet spot:

The concept of an endurance component really resonates with me as I intend to do what I am doing to the end – because I can. And because those four circles are intersecting for me.

We know traditional retirement is dying a fast death and that 50+ years of the same financial services industry vocation-to-vacation drumbeat is fading.

Who would have thought those lazy, over-protected, self-entitled Millennials may drive the final stake in both.

Follow Rocco

Forums like Medium.com may not be your thing (there’s some pretty edgy stuff over there), but I encourage you to check out what Rocco is saying. It won’t harm any of us “Modern Elders” to be more generative and crawl inside the mind of a forward-thinking GenXer.

Does your third age have an endurance component? Let us know what you think of this idea? We’d love to have your feedback. Leave a comment below or email me at gary@makeagingwork.com.

Howdy! Would you mind if I share your blog with my facebook group? There’s a lot of folks that I think would really appreciate your content. Please let me know. Thank you

To the makeagingwork.com admin, Your posts are always well organized and easy to understand.

Dear makeagingwork.com admin, Thanks for the well-organized post!

To the makeagingwork.com administrator, Keep the good content coming!

To the makeagingwork.com admin, Well done!

You have remarked very interesting details ! ps decent website .

To the makeagingwork.com owner, Your posts are always well-referenced and credible.

Hi makeagingwork.com admin, Thanks for the educational content!

Hi makeagingwork.com admin, Your posts are always well written and informative.

Hi makeagingwork.com admin, Your posts are always well written.

Dear makeagingwork.com owner, Good job!

Hi makeagingwork.com administrator, You always provide great resources and references.

To the makeagingwork.com owner, You always provide key takeaways and summaries.

Hello makeagingwork.com owner, You always provide in-depth analysis and understanding.

To the makeagingwork.com admin, Keep up the good work!

To the makeagingwork.com webmaster, Keep up the good work!

Hi makeagingwork.com administrator, Great job!

To the makeagingwork.com admin, Your posts are always on topic and relevant.

To the makeagingwork.com webmaster, Thanks for sharing your thoughts!

To the makeagingwork.com administrator, You always provide great insights.