Are Millennials and GenXer’s More Prepared Than Previous Generations for Retirement? Probably Not? So What?

I’m not sure how many in my subscriber tribe fall in the GenX or millennial age category. I’m guessing not the majority. Regardless, I’m forging forward with this message because it also has relevancy for us modern elders.

Statistics are revealing that the millennial and GenX generations are less financially prepared for retirement than previous generations. Here’s a chart that supports that:

The chart sends off some pretty scary signals if you are stacking it up against the still prevalent view of where one should be to experience traditional, full-stop retirement.

Here are some headlines from a Business Insider article quoting a Boston University economist who warns that GenXers and millennials will be facing a “retirement crisis.”

-

-

Over half of Gen Z and millennials could enter retirement with insufficient savings, says a Boston University economist.

-

With inflation rising, the magic number for a comfortable retirement could be close to $3 million.

-

Working later in life to catch up on savings might not be a tenable solution.

-

The article goes on to suggest that, while $1 million has long been considered the “magic number for retirement savings”, for late GenXers and millennials that number should be closer to $3 million.

Chew on that for a second and do the math.

So, you’re 30 and have $37K in the bank. A well-meaning financial planner suggests that you should find an occupation and adjust to a lifestyle that will enable you to accumulate that $3M over the next 35 years (he/she probably still holds the number 65 as sacrosanct).

That’s too much math for me to calculate, but I’m comfortable suggesting that you will need to start saving somewhere around $2500-$3000 per month.

Uh – have fun with that!

Even if you are a slug and settle for a mere $1 million, the number is still a lifestyle-destroying number.

That’s why the retirement story is changing.

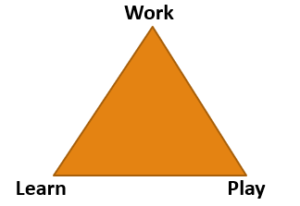

Although far too many of us pre-boomers and boomers continue to infer it, GenXers and millennials aren’t stupid. They are very aware. Many are looking at the consequences of previous generations’ commitment to the 20th-century linear life model of Learn – Earn – Retire – Die and deciding they want no part of it.

They are realizing it isn’t about the numbers, but about the lifestyle. They see no logic in a model that suggests 30–40 years of busting your hump and sacrificing health and relationships to achieve a number to support what, for far too many, is a retirement that is shorter than expected and full of health challenges as a result of the stress and poor lifestyle habits built into this old model.

Traditional, full-stop retirement is dying –

-and GenXer and millennials are helping drive the demise.

There is a growing “never retire” movement beginning to develop that eschews traditional retirement in favor of a life plan that calls for retiring into a lifestyle early in life doing what you enjoy most, are good at, that brings value to the world and the community, that supports their financial needs, and that they can do late into old age if they choose.

Call it a “never retire” model.

Yep, it’s totally antithetical and counter-cultural. But, it recognizes that the Learn-Earn-Retire-Die model worked 50 years ago, but makes no sense now. Learning and earning can be spread over the lifetime and in a way that is more fulfilling, less stressful, less selfish, less self-indulgent, and more in step with how our lifespans and healthspans are changing.

So, yes GenXers and millennials are less prepared for the archaic, traditional retirement model but are growing in their awareness of a more sensible, logical, relevant model that puts lifestyle and experience ahead of money and puts them on a path for a longer, healthier, and more fulfilling lifespan.

Should we be taking notes?

The reality is that lots of us modern elders – especially the younger boomers who missed the internet boom – aren’t financially prepared to support our extended life spans. Check out that $280K average retirement savings for the 65+ in the chart above. That may get us a lifetime of bingo and backgammon, but not much else.

Sorry, Mabel – the Norwegian cruise is off the table.

Maybe it’s not too late for us to listen to these youngers and jettison the retirement mindset and consider the never-retire option. I’ve been giving semi-retirement a go for almost two decades now balancing labor, leisure, and learning and it feels increasingly comfortable as the years advance.

But, no one wants to be me – including me more days than I wish to admit.

I’ll keep rolling with this model until the parts give out.

Maybe those behind us are onto something!

Whaddayathink about this? We’d love to have your two cents worth – or more. Leave us a comment or shoot an email to gary@makeagingwork.com.

So interesting that you wrote this. I have just finished reading The Hundred Year Life and have started thinking about something very similar. And from a slightly different angle.

The Boomers instigated a lot of social/societal change with the advent of birth control, civil rights, the assassination of several of our political icons, Vietnam, the prospect of nuclear destruction.

The Millenials and Gen Y & Z are now instigating a lot of social/societal changes, including how they approach work, family, relationships and the future. They are concerned with whether there will be a future because of the fear of climate change. They have experienced Black Lives Matter, the Jan. 6 insurrection, most of grown up in the post 9-11 world.

It seems to me that rather than focus on the differences between the generations, these cohorts of social change could collaborate and learn from each other. Who knows what interesting things could come out of that?

I’d like to preface this by saying I have owned and operated a nursing home for forty years. I just sold my facility on November 15th. Unfortunately no one knows how their last few years on this earth will go. Care costs real money. As much as we would like to believe that we will never need care , this is very often not the case. Just saying!