Are Your Genetics Trapping Your Mindset?

Me: So, John – how long do you expect to live?

John: Well, I’ve never been asked that question. Probably mid-eighties.

Me: John, you’re 72 and healthy – why the mid-eighties?

John: Oh, genetics, I suppose. My dad died at 63. My mom was in her late eighties.

Me: Suppose I told you that we’ve determined that genetics may play, at most, a 30% role in our longevity and virtually no affect after age 65 – would that influence how you began to feel about how long you will live?

John: Well, maybe – I’ve never heard that. I’ve always assumed genetics determined how long I would live.

Thus went a portion of a multi-faceted, catch-up discussion over lunch this week with a friend of mine – a fellow executive recruiter with whom I’ve shared some of my passions for living healthy, not retiring, staying productive.

John’s a guy that subscribes to all of that, so we’ve hit it off well in the several years we’ve known each other. He’s an energetic, engaging, fun guy to be around. He continues to maintain a successful IT recruiting business, started at “mid-life” 22 years ago after an extended stint in big-company CIO roles.

He has no intention of retiring.

His rationale is pretty simple:

- He still enjoys recruiting, although it’s gotten a lot tougher with the advent of the internet and the fact that a number of his key client contacts have retired or died early. He admits to some complacency and the need to resurrect some of the old success habits that got him where he is.

- He would go stir-crazy if he retired. John is an extrovert that is empowered by being around people. He told me he can’t sit still for more than a couple of hours before he has to talk to somebody, live or on the phone. (NOTE: that has a lot to do with his consistent success as a recruiter. Mildly demented total introverts, like me, don’t show up in the stats of highly successful recruiters).

- The money is still good in recruiting and he’s good at it. Why quit? What would I retire to, he asks?

- He’s in a business that is largely age insensitive. You find a needy client the problem-solving candidate they need, they could give a rip if you are 12 or 92.

- He has the lifestyle he wants: good income, industry reputation, total control of his calendar; a “significant other” that he enjoys spending time with (he’s divorced 20+ years with no intent to re-marry); large but dwindling circle of close friends that he consistently spends time with (maybe a few early deaths amongst friends has influenced his perspective on his own length of life – I didn’t probe that.)

Summary: FREEDOM!

John’s a healthy guy. He eats right – lots of fish, no meat. He is slender. He does a little bit of strength training (not enough, I told him.) He is a gonzo road biker, doing long rides multiple times per week with friends.

I chuckled as he complained that his average mph has dropped in the last ten years from 17 mph to 13mph on the extended road trips. In the same breath, he proudly states that he hasn’t found many 40-year olds that can keep up with him even today.

Why check out early?

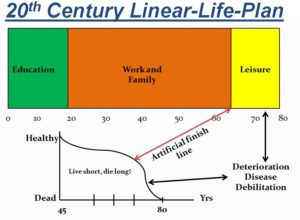

Given all this about John, I was a bit surprised to have him set such a limited time horizon for himself. It seemed out of sync with the rest of John’s thinking and lifestyle. That is until I realized that, like so many other 20th- century myths that we have brought forward, he was coming from the outdated assumption that genetics drives our longevity. He was surprised to hear that this isn’t the case and that our longevity is largely driven by the lifestyle choices we have made and will continue to make.

I think – I hope – I sensed a bit of awakening on his part to the possibility that a mid-eighties demise is accepting an unnecessary shortfall. He is certainly doing the things that would say that maintaining his current level of energy, drive, and vitality at the age he expected to die is a very real possibility.

When we injected the theory of “self-fulfilling prophecy” into the discussion I believe some new lights came on.

I reminded him of my own personal longevity goal of 112 ½ and how setting a WIG (wildly improbable goal) like that has changed my perspective on what I want to do in this third act and my optimism about being able to do it.

Like all others I share this goal with, he thinks that kind of threshold is a bit nutty. But I’m predicting that when he hits 85 and he’s still kicking it – be it recruiting, biking, or whatever – he will have a different viewpoint.

John does, and will continue to, qualify as an “audacious ager.” I love meeting and learning from audacious agers. If you know of others like John that I could talk with, please send them along.

And that’s where it is now. His daughter is full-time as an O.D. in the practice as his partner, joined by another part-time O.D. and with Per as the head optician along with a couple of other opticians. The business is off and flying again – in fact, in the midst of a major remodel and expansion of their current facility with Per committing 50 hours a week in dual roles as the head optician and overseer of the renovation project.

And that’s where it is now. His daughter is full-time as an O.D. in the practice as his partner, joined by another part-time O.D. and with Per as the head optician along with a couple of other opticians. The business is off and flying again – in fact, in the midst of a major remodel and expansion of their current facility with Per committing 50 hours a week in dual roles as the head optician and overseer of the renovation project.

Now 87, Shatner looks 20-years younger and is living like his hair is on fire (yes, he still has plenty) – writing books; doing a country-western album, a blues album, and a Christmas album; touring internationally; producing, directing and performing on NYC Broadway stage; speaking.

Now 87, Shatner looks 20-years younger and is living like his hair is on fire (yes, he still has plenty) – writing books; doing a country-western album, a blues album, and a Christmas album; touring internationally; producing, directing and performing on NYC Broadway stage; speaking.

With both ladies, I posed the coaching question: “If we were to take away time and money as a factor, what would you be doing?”

With both ladies, I posed the coaching question: “If we were to take away time and money as a factor, what would you be doing?” expectations.

expectations.

So how could it possibly be HALF?

So how could it possibly be HALF?

I’m hanging out a “Help Wanted” sign.

I’m hanging out a “Help Wanted” sign.

To give you an idea of this man’s talent (and in hopes of adding you to his fan club)

To give you an idea of this man’s talent (and in hopes of adding you to his fan club)