Retirement worse than smoking? Maybe.

This should make you stop and cogitate a bit: the health risk of prolonged isolation is equivalent to smoking 15 cigarettes a day.

That’s according to the AARP Foundation. I didn’t know AARP was doing that kind of deep biological, bio-scientific research. But who’s going to doubt the mighty AARP? Warren Buffett proved it long ago – selling insurance can support lots of things.

The article caught my eye because I’m a bit of a hermit, by nature and vocation, and a former smoker.

But the connection doesn’t resonate with me.

Smoking was stupid

And quitting was tough. But it was the best thing I ever did when I quit on 6/6/79. It was a launching pad for a whole new level of self-esteem and self-respect.

Isolation is built into what I do as a home-based recruiter, coach, and writer and it fits me as an introvert. I empower myself through my reading, writing, and thinking and through occasional deep, stimulating conversations with a selective tribe of friends.

I don’t do crowds well – and small talk drives me crazy and reminds me, every time, of my shrinking calendar. I’m inspired by what I do and draw a great deal of energy from my activities despite doing them largely in physical isolation.

I’m just not psychologically isolated. I believe that’s where the difference lies.

Loneliness sucks!

I do understand what they are saying because I’ve seen the ill effects of psychological isolation.

If you click on over to the AARP article, you’ll find a list of “Risk Factors for Isolation” and – Voila! – there’s retirement smack in the middle, in the same sentence with becoming a caregiver and losing a spouse.

Robert Waldinger, Professor of Psychiatry at Harvard Medical School and Director of the Harvard Study of Adult Development, one of the world’s longest studies of adult life, said in this popular TED Talk, “The people in our 75-year study who were the happiest in retirement were the people who had actively worked to replace workmates with new playmates.”

Now, wait a minute. You mean the golden ring, the coveted prize at the end of our labors, that late-life nirvana, that sole reason we’ve been busting our butts for 40 years doing something we marginally enjoyed or felt good about – it’s all really just a hoax? You mean it’s gonna make me age faster and die sooner?

Mostly. But it’s a big “it depends.”

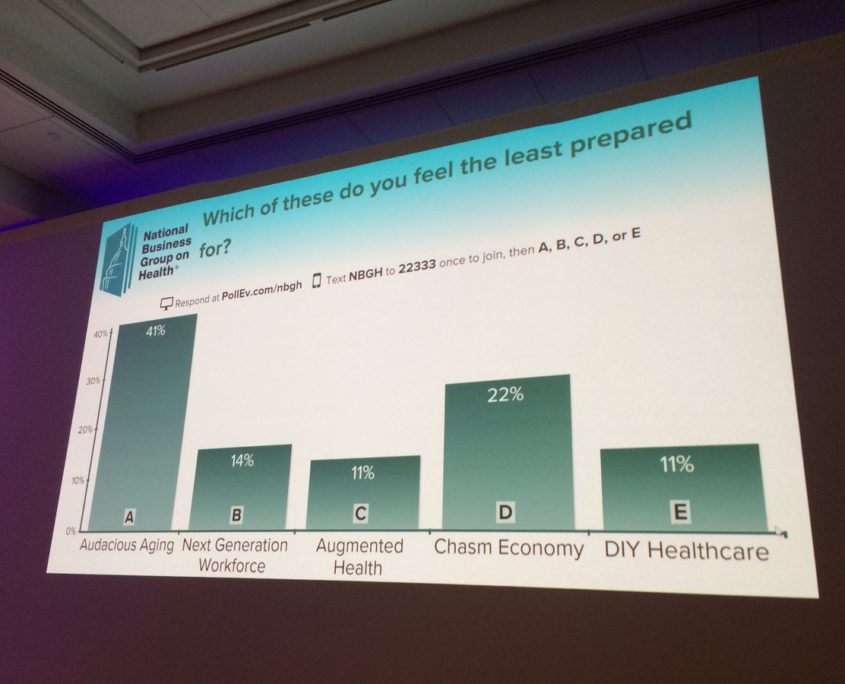

We’re learning that pre-retirees are best served when they devote as much attention and energy to the non-financial components of retirement as they do to the financial components. Research indicates that upwards of 70% of retirees enter into their retirement with little or no attention to the psychological, emotional and physical dark side of retirement.

Increased isolation is but one of those potential pitfalls but perhaps the most destructive.

There is a hidden epidemic that takes place in the shadow of retirement. Some of the emerging statistics are alarming, all of which can be attributed, in part, to increased isolation;

- The National Institutes of Health reports that of the 35 million Americans 65 or older, nearly 2 million suffer from full-blown depression. Another 5 million suffer from less severe forms of the illness.

- Conditions such as heart attack, stroke, hip fracture, or macular degeneration, as well as procedures such as bypass surgery, are known to be associated with the development of depression.

- Men older than age 65 take their own life at more than double the overall rate and are four times more likely to kill themselves than women in the same age group. Perhaps surprisingly, men age 75 and older have the highest annual suicide rate of any group – about 39 deaths per 100,000. In contrast, the rate for women peaks between ages 45 and 64 at nearly 10 deaths per 100,000. The suicide rate among men 45-64 increased by nearly 50%, between the years 1999 and 2014.

The numbers of older people affected by loneliness and isolation are striking.

According to the new AARP Foundation website Connect2Affect:

- 17 percent of American adults 65 and older are isolated

- Research shows a 26 percent increased risk of death due to the subjective feelings of loneliness

- 6 million adults 65 and older have a disability that prevents them from leaving their homes without help

- 51 percent of people 75 and older live alone

All this is part of the reason that I have decided to devote more of my life and coaching practice to retirement coaching.

The reach for traditional, off-the-cliff, labor-to-leisure concept of retirement still seems to prevail. That despite the fact we are at a place we’ve never been before with extended longevity facing unprecedented changes in the economic, financial and self-care landscape. Retirement that isn’t carefully planned carries with it significant life-shortening health risks.

And with this mindset, many retirees continue to step into a minefield of unexpected challenges, not the least of which is isolation. It goes hand-in-hand with loss of identity, loss of sense of purpose, declining social engagement and creeping health issues emanating from a sedentary lifestyle and historically poor diet.

And with this mindset, many retirees continue to step into a minefield of unexpected challenges, not the least of which is isolation. It goes hand-in-hand with loss of identity, loss of sense of purpose, declining social engagement and creeping health issues emanating from a sedentary lifestyle and historically poor diet.

A new retirement emerging?

The wiser of “retirees” are beginning to redefine retirement to prevent the above. For many, that means continuing to make some level of that previously disdained four-letter word -WORK – part of their lives. With it comes a solution to the problems of isolation, purpose, inactive lifestyle.

I wrote about the importance of work in my 12/18/17 blog “Work Yourself to Death? Not a Bad Idea!”

Work with a purpose is a new catchphrase amongst retirees. Or collecting a “playcheck”, a term coined by Mitch Anthony in his book “The New Retirementality”, – being paid for something you really truly are meant to do, that is fun and fulfills a deep inner purpose.

Work and play can intersect. And there is no better time for that to happen than in a “re-defined retirement”, bringing forward acquired skills and experience and applying them to something fulfilling, fun and profitable.

Who do you know that has achieved that work-play intersection? Or maybe it’s you. Scroll down and leave a comment. While you are there, sign up for our free e-book “Achieving Your Full-Life Potential: Five Easy Steps to Living Longer, Healthier, and With More Purpose.”

Five stages of retirement – proceed with caution.

Five stages of retirement – proceed with caution.

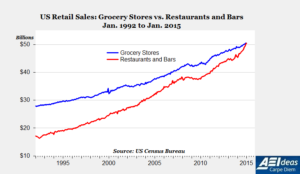

(2) CDC has estimated that 40% of the U.S. population is overweight. Hmmmm! Any correlation? Calorie-levels of restaurant food is 20-30% higher than food prepared at home – and portions are ridiculous. Bring it home and be a “flexitarian” – plant-and fruit-heavy diet with occasional “meat as a treat.”

(2) CDC has estimated that 40% of the U.S. population is overweight. Hmmmm! Any correlation? Calorie-levels of restaurant food is 20-30% higher than food prepared at home – and portions are ridiculous. Bring it home and be a “flexitarian” – plant-and fruit-heavy diet with occasional “meat as a treat.”

George Burns was guilty of some really fabulous quotes, most of them quite funny, some deadly serious. Many had to do with his advancing age (he died in 1996 at age 100). Here are a few:

George Burns was guilty of some really fabulous quotes, most of them quite funny, some deadly serious. Many had to do with his advancing age (he died in 1996 at age 100). Here are a few:

I see this frequently as I engage potential candidates regarding executive or middle-management opportunities in my recruiting business. Because most of the positions call for deep experience and expertise in a given area, I’m often reaching out to professionals who have entered the “second half” or “third stage” of their lives – likely facing fewer days ahead than behind.

I see this frequently as I engage potential candidates regarding executive or middle-management opportunities in my recruiting business. Because most of the positions call for deep experience and expertise in a given area, I’m often reaching out to professionals who have entered the “second half” or “third stage” of their lives – likely facing fewer days ahead than behind. Learning after school didn’t go much beyond what the job required and the pace of change, until digitization arrived, was mostly modest and manageable without much skills upgrade. Today, new technologies are rapidly outstripping and obsoleting many skills and may be dropping your value in the marketplace. Gaps will be revealed quickly in the job search process. It’s imperative in today’s job market to stay current and continuously upgrade your skill set to be in step with technology developments.

Learning after school didn’t go much beyond what the job required and the pace of change, until digitization arrived, was mostly modest and manageable without much skills upgrade. Today, new technologies are rapidly outstripping and obsoleting many skills and may be dropping your value in the marketplace. Gaps will be revealed quickly in the job search process. It’s imperative in today’s job market to stay current and continuously upgrade your skill set to be in step with technology developments.

“Life is a fatal disease. Once contracted, there is no known cure”

“Life is a fatal disease. Once contracted, there is no known cure” I would be delusional to think that you’ve been eagerly awaiting a blog on aging, what with only 100 million other blogs out there and the rather “uncomfortable” nature of the subject.

I would be delusional to think that you’ve been eagerly awaiting a blog on aging, what with only 100 million other blogs out there and the rather “uncomfortable” nature of the subject. A prominent Yale physician, Dr. David Katz, founder of the school’s Prevention Research Center, got my attention a few years ago when I heard him say:

A prominent Yale physician, Dr. David Katz, founder of the school’s Prevention Research Center, got my attention a few years ago when I heard him say: This journey may be a bit idealistic but I’m venturing forth nonetheless with my crusade-like mission, sharing what I hope will be valuable, meaningful information and resources.

This journey may be a bit idealistic but I’m venturing forth nonetheless with my crusade-like mission, sharing what I hope will be valuable, meaningful information and resources.