What Type of Retiree Are You – or Do You Want to Be?

A few months ago, as a favor for a friend, I did a webinar entitled “What’s Next? Redefining Retirement and Creating Power and Purpose in Your Post-career Life” for one of the local Christian Living Communities’ senior-living facilities.

Not exactly my “target market” since my focus is more on folks who are approaching, or are early into, their retirement years.

Let’s just say that, although well-attended, the post-webinar response was thin, at best. I wasn’t surprised – or disappointed. I knew going in that “What’s Next” for most of these community residents had been locked down some time ago and their interest in the “new retirementality” and the changing views on retirement would be less than overwhelming.

However, my research for the project came up with some rather cool insights into the evolving retirement landscape. I decided to share some of the fruits of the research.

So, in keeping with my bent toward abject plagiarism (properly attributed) and lack of originality, I share two insights. One from a financial planning firm, Advanced Capital Management (ACM), and another extracted from Ken Dychtwalds book that I introduced last week: “What Retirees Want: A Holistic View of Life’s Third Age.”

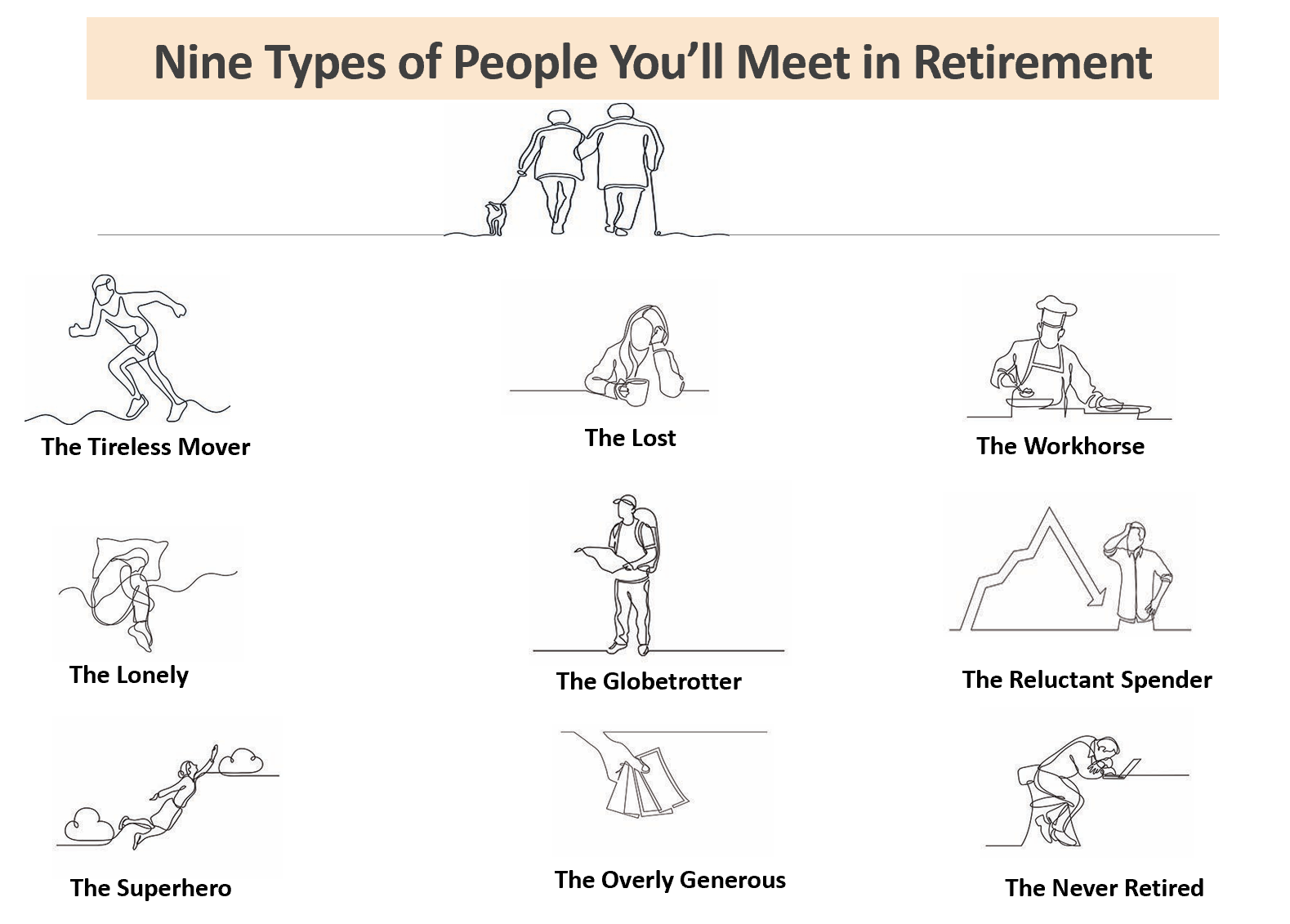

ACM produced this clever graphic for one of their blogs. You can see the full blog here. I’m just doing cliff notes below.

Source: Advanced Capital Management, Financial Living Blog

Retired? Which one (or more) describes you?

Considering retirement? Which one (or more) do you want to be?

This may help you decide – or at least plan better.

1. The Tireless Mover

“This person is always on the go, with a bucket list that is seemingly as long as a CVS receipt – trying to sky dive for the first time or seeing the Rolling Stones for the 100th time.”

2. The Lost

“– research has found some people experience ‘anxiety, depression and debilitating feelings of loss’ after retiring. Too often people can put too much focus on money when planning for retirement. It’s important to also plan for the social and psychological shifts, such as coping with the loss of your career identity, forming new relationships, and finding things to do to pass the time.”

3. The Workhorse

“A working retirement? Isn’t that an oxymoron? For many retirees, it’s not. And, they’re not working just for financial reasons. A FlexJobs’ survey of over 2,000 professionals at or near retirement found that 70% need to work to pay for basic necessities, but almost 60% said they work because they enjoy it. Work can provide meaning and a sense of purpose in retirement.”

4. The Lonely

” According to the National Poll on Healthy Aging, researchers at the University of Michigan found that one in three seniors are lonely. Studies indicate that loneliness can harmfully impact older adults’ physical and mental health and shorten life expectancy.”

5. The Globetrotter

“Your interactions with this person may be primarily in the form of either postcards sent from abroad or envious selfies in front of famous landmarks. Survey after survey ranks travel as one of the top retirement activities.”

6. The Reluctant Spender

“In a 2018 study published in the Journal of Personal Finance, half of retired survey respondents said they were afraid to use their savings.” Primary reasons? Healthcare costs and rise and fall of the stock market. “It’s perfectly okay to have concerns about spending, but it should not inhibit your ability to enjoy everything you’ve worked so hard to achieve.”

7. The Superhero

” Not all superheroes wear capes. In fact, most wear T-shirts emblazoned with the word “volunteer.” And, many of those real-world superheroes are retirees. Two-thirds of retirees say they’ve found retirement to be the best time in life to give back.”

8. The Overly Generous

“Some parents and grandparents can’t help themselves. It becomes a problem though when children start to become a financial burden on their retirement goals, which is increasingly common.”

9. The Never Retired

“With only 16% of Americans having saved $200,000 for retirement, according to a 2019 Northwestern Mutual study, it’s a good bet you’ll meet people the same age as you who may never retire.This helps explain why a growing number of Americans expect to work longer. AARP’s Life Reimagined survey found more than half of respondents plan to work past the traditional retirement age of 65. Eleven percent say they expect to keep working into their 80s or beyond.”

A Healthy Perspective

Ken Dychtwald’s research for the aforementioned book looked at Boomer’s perspective on health, revealing that some Boomers are health conscious but many are not.

His surveys found “-four basic health styles among Boomers, based on their condition and approaches to health itself, getting health care, and preparing for health expenses in healthcare.”

Here are more cliff notes:

Healthy on Purpose

These Boomers consistently do what’s good for their health, physically and financially. They take pride in their health, eat right, exercise, and don’t let things interfere with their disciplined approach to protecting their health.

Coarse Correctors

A wake-up call has these Boomers paying more attention, causing them to take better care of their health. While most are diligent in their health behaviors, the majority also say they still let things get in the way of attending to their health.

Health Challenged

Conditions, often chronic, keep this group from doing many things they enjoy. While most are concerned about their health and how to pay for it, only 2 of 5 are actively attending to their health, saying that other responsibilities and worries interfere.

Lax but Lucky

This group likely has their genes to thank and not their behaviors because they do not take care of themselves but manage to remain somewhat healthy. Only about a third try to engage in healthy behaviors or seek information on improving their health.

Dychtwald says that roughly 30% fall into each of the first three categories and 10% in the Lax but Lucky.

Nice work, guys (NOT!)

No surprise here (albeit disappointing): women are in the majority in the first three categories and men in the majority of the Lax but Lucky.

Can you spell “EGO”! “MACHO”!

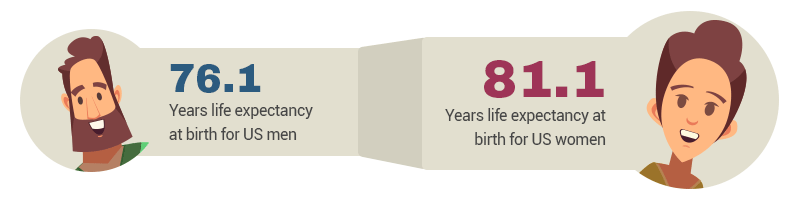

Scoreboard:

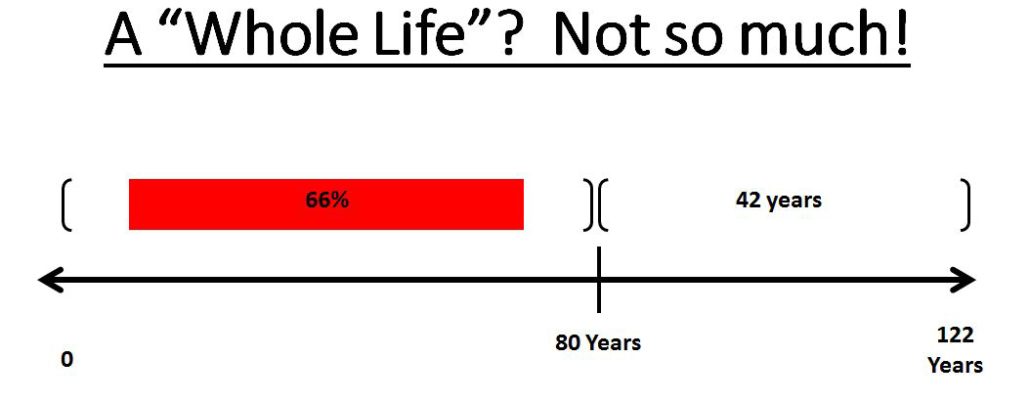

‘nough said. We’ve all got work to do. At the risk of being abrasively repetitive, I’m compelled to remind those who will bother that we, on average, only achieve about 66% of our biological potential. We know that the body will last 122 years and 164 days because Jeanne Calment of Arles, France set that benchmark for us when she checked out in 1997.

I think it’s worth mentioning that rather than filling that 42-year gap, we are currently opening it, with our average lifespan receding.

It’s no longer fate or genes. It’s now about choice.

It’s about “Healthy on Purpose.” And planning ahead to avoid #2 and #4 in the retiree type graphic.

As always, your thoughts and comments are welcome and helpful. Scroll down and leave a comment or email your thoughts to gary@makeagingwork.com

Gary, Great article with lots of information to help us focus on how to achieve an enjoyable quality of life.

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your website to come back later. Many thanks

Hi makeagingwork.com administrator, Keep up the great work!

Dear makeagingwork.com webmaster, Thanks for sharing your thoughts!

To the makeagingwork.com owner, Keep sharing your knowledge!

Can I simply say what a aid to search out somebody who truly is aware of what theyre talking about on the internet. You definitely know learn how to deliver a problem to light and make it important. Extra people must learn this and perceive this facet of the story. I cant imagine youre not more common since you undoubtedly have the gift.

To the makeagingwork.com owner, You always provide valuable information.

Hi makeagingwork.com owner, Thanks for the in-depth post!

Hello makeagingwork.com admin, Your posts are always well written and informative.

Hello makeagingwork.com admin, Your posts are always well-timed and relevant.

Dear makeagingwork.com webmaster, Good work!

To the makeagingwork.com owner, Your posts are always well-referenced and credible.

To the makeagingwork.com admin, Keep up the good work!

To the makeagingwork.com admin, You always provide useful tips and best practices.