Retirement: Blessing or a curse? The jury has returned. But it’s still hung.

Image by Gerd Altmann from Pixabay

Imagine it’s your first-time meeting with a certified financial planner, a financial services veteran with a string of acronyms after his/her name.

Imagine the conversation going like this:

“Welcome, so glad to meet you. I’ve been looking forward to having this conversation with you. It’s a great day for me when I can help another couple hop on the trail of false expectations and backward logic. So, let’s talk about your retirement goals.”

OK, that conversation won’t happen. He/she didn’t get that plush office and wall full of certification plaques by telling the whole story.

But, maybe it should happen because that type of conversation would come closer to reality than most of the conversations that go on in those financial planner offices.

Retirement Kool-Aid

We’ve been buying into retirement as a blessing ever since clever insurance salespeople determined that the idea of escaping from work into a world of freedom and relaxation with a healthy allowance for fun is a pretty easy sell. Especially when you can package it up with the government’s authorization of instruments like IRAs and 401ks as pensions fade away.

So, we’ve been drinking the full-stop retirement Kool-Aid for about five decades – to the point that the concept has become a pseudo-entitlement that is virtually unassailable.

I’ve shortened and put the dagger into the heart of more than one lagging dinner conversation amongst my age cohort by suggesting that retirement is an unnatural and illogical act with many hidden downsides.

They will agree, however, that their financial planner (if they have been smart enough to have one) has not revealed some of the hidden downsides of full-stop retirement, such as:

- 5-16% increase in difficulties associated with mobility and daily activities.

- 5-6% increase in illness conditions.

- 6-9% decline in mental health.

Or, that:

- 20% of Americans 65 and older suffer from moderate to high levels of depression.

- Men over 65 take their own lives at double the overall suicide rates and men age 75 and older have the highest suicide rate of any age group.

Nor will they share the backward logic of the full-stop retirement concept:

- Retirement didn’t exist anywhere on the planet 150 years ago, doesn’t occur in nature, doesn’t exist in cultures with the highest average lifespans, and is built around a concept that, by definition, means to “go backward.”

- A lifestyle built on leisure leads to decay and goes against our basic biology/physiology.

- Work has been determined to be a key component of healthy longevity.

Despite all this, a surprising percentage of boomers and early GenXers continue to buy the 20th- century linear-life model of 20 years of learn, 40 years of earn, and 20 years of retire/relax.

An important missing part in these conversations is that it is very difficult to save enough in those 40 years to support 20 years of doing nothing, not to mention that the stress and bad lifestyle habits that occur during that “bust the hump” period don’t bode well for that final 20 being a healthy period.

The average retirement savings by age, according to 2019-2020 Federal Reserve SCF data isn’t very pretty:

- 18-24: $4,745.25

- 25-29: $9,408.51

- 30-34: $21,731.92

- 35-39: $48,710.27

- 40-44: $101,899.22

- 45-49: $148,950.14

- 50-54: $146,068.38

- 55-59: $223,493.56

- 60-64: $221,451.67

- 65-69: $206,819.35

Fewer people are going to get to the numbers the financial planner’s charts and graphs say is necessary to sustain a healthy retirement.

And, speaking of health – – –

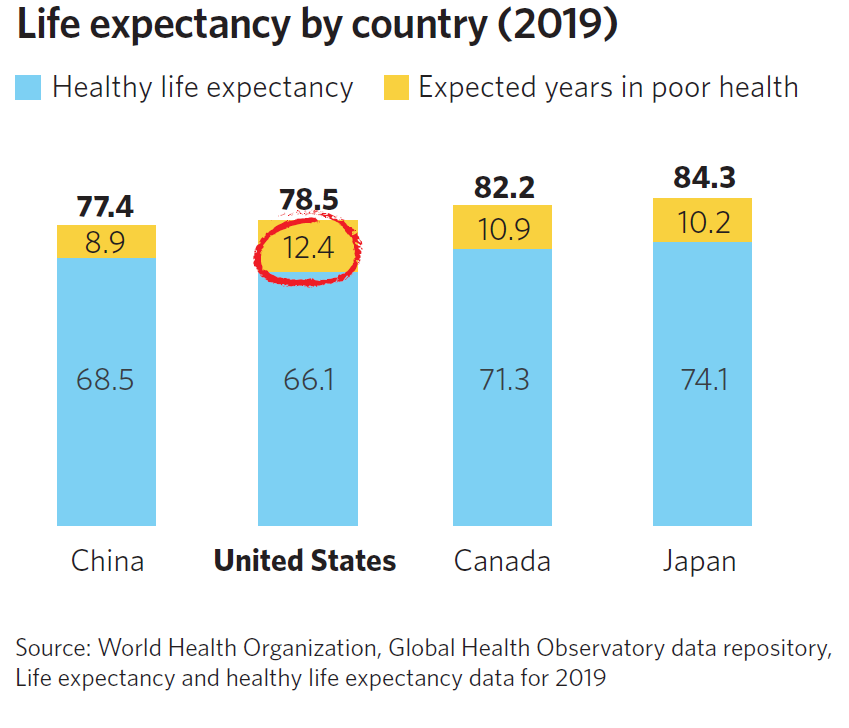

It’s an unfortunate fact that, in the U.S., the average time spent in ill health for our elderly is the highest for all developed countries at 12.5 years, a really big chunk of that coveted 20. Do you suppose part of that comes from the stress of trying to meet false expectations?

The retirement planning disconnect

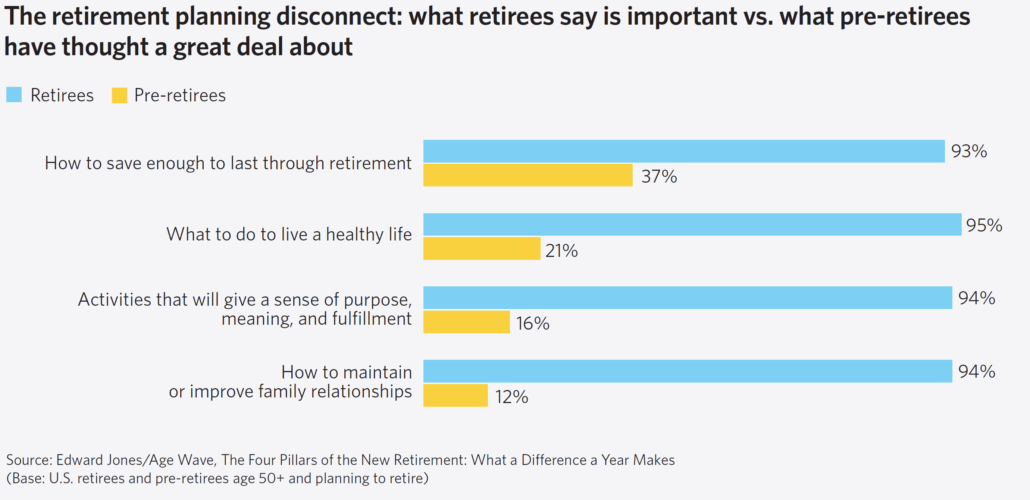

Dr. Ken Dychtwald and his Age Wave organization teamed in 2019 to explore people’s hopes, dreams, and concerns in retirement. Together with The Harris Poll, they conducted a groundbreaking study of more than 9,000 people across North America to understand more deeply what it means to live well in retirement.

The report, entitled “Longevity and the New Journey of Retirement” is a very comprehensive report that is a worthy read.

There are numerous takeaways from the report. I want to emphasize one in particular: the attitude toward preparedness for retirement and the lack therein.

The chart from the report pretty well says it all:

Financial planners are not equipped or interested in addressing three of these four gaps.

Blessing or a curse?

So the jury that is this report tells us that retirement is a curse for over 30% of retirees and a near-curse for another 20%.

We can do better with this third-third of our lives by recognizing the four pillars above and planning ahead for them.

Trackbacks & Pingbacks

[…] what did surprise me was when a short time later, another Dychtwald report – which I referenced last week – points out something different […]

Leave a Reply

Want to join the discussion?Feel free to contribute!