What are the chances that the following statement would be found in any of a financial planner’s training manuals? “Ironically, jobs are actually easier to enjoy than free time, because like flow activities they have built-in goals, feedback rules, and challenges, all of which encourage one to become involved in one’s work, to concentrate… Continue reading Why Your Free Time In Retirement Doesn’t Feel Right.

Category: Retirement

Can We Become Age-agnostic? Do Your Part – Be a “Perennial”.

Image by Mabel Amber from Pixabay The deeper I get sucked into this vortex of dialog about aging – older vs elder, saging versus aging, retirement versus rewirement, etc., etc., ad nauseum – the more I sense that we are creeping to the edge of an age-agnostic era. What does that mean? It means that instead of our… Continue reading Can We Become Age-agnostic? Do Your Part – Be a “Perennial”.

Are You On a Two-tank Journey With a One-tank Mindset?

Image by Hebi B. from Pixabay Stan is a C-level executive in his late fifties. He’s done well, thriving and progressing in the volatile, high-pressure world of healthcare. Also, like many at his level in this chaotically-evolving industry, his career was recently disrupted when he was laid off, despite a stellar performance record, following the merger of two… Continue reading Are You On a Two-tank Journey With a One-tank Mindset?

On Becoming a “Sage” – A Podcast

I had the good fortune recently to be asked to do a guest interview with Jann Freed, PhD, on her “Becoming a Sage” podcast. Jann is a well-known business consultant specializing in strategic planning, leadership development, and life planning. You can learn about her and her services at www.leadingwithwisdom.net. Jann liked my guest post on… Continue reading On Becoming a “Sage” – A Podcast

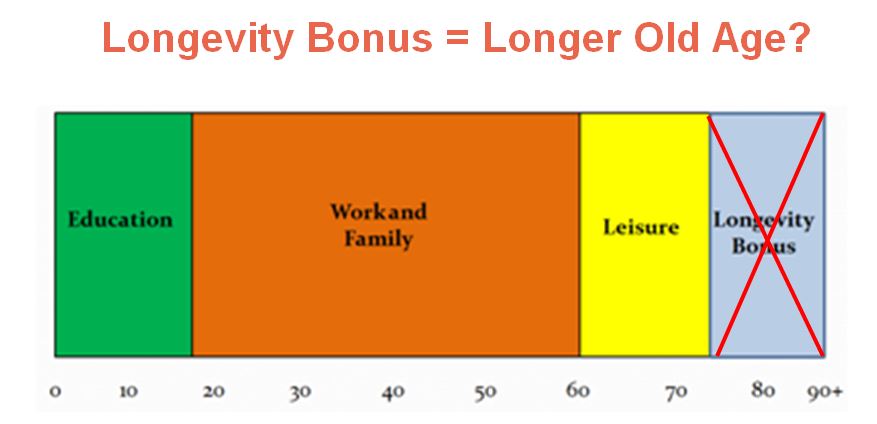

Older for Longer? Or Younger for Longer? The Choice is Ours.

Chances are pretty good that you may live 20 or more years longer than your parents. If you hit 65 without major illness, you have a better than even chance you will live to 90 or beyond. So the prospect of 25-30 more years beyond the average retirement age in the U.S. puts us in… Continue reading Older for Longer? Or Younger for Longer? The Choice is Ours.

It’s Time to “Take Back and Own” Your Elderhood

How did you react when you received your AARP card just before your fiftieth birthday? Were you: Surprised and shocked. Flattered Excited Ambivalent Pissed Surprised? We probably don’t want to know how much they know about us. Flattered? Just a thought – you might want to raise the bar. Excited? You love those weekly Bed… Continue reading It’s Time to “Take Back and Own” Your Elderhood

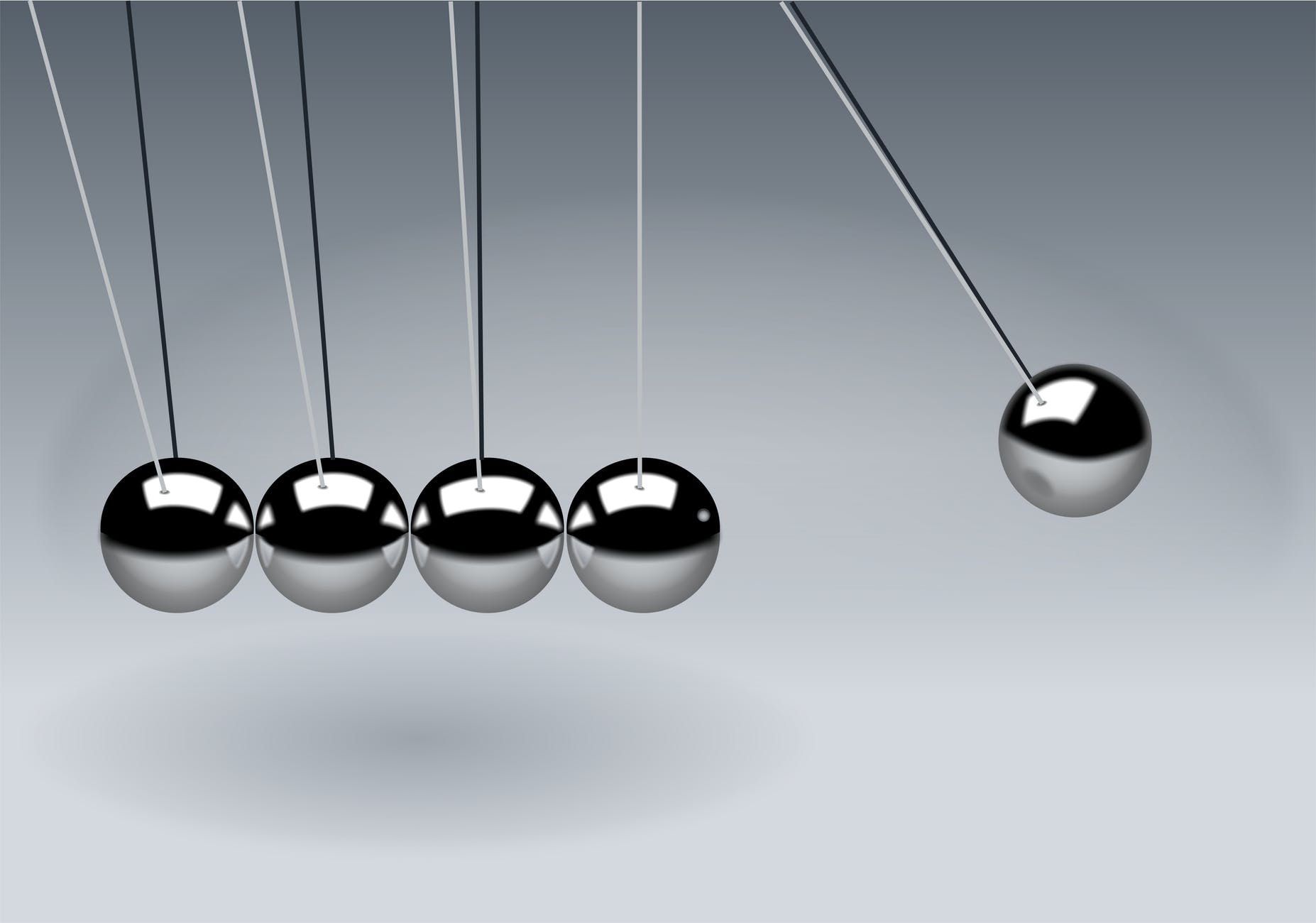

Retirement, the First Law of Physics, and the Iron Oxide Risk

Isaac Newton was a great physicist. Maybe not by today’s standards, but he helped us move forward with some pretty big leaps back in his day. Like (1) deciphering gravity; (2) inventing calculus; (3) building the telescope. He also introduced the “First Law of Physics”. This law is sometimes referred to as the law of inertia… Continue reading Retirement, the First Law of Physics, and the Iron Oxide Risk

Be Part of the “Modern Elder” Movement

Photo by Esther Ann on Unsplash A couple of years ago, while one with my now-deceased iPod Classic during a workout, I listened to a very stimulating podcast interview with Chip Conley, who, at the time, was a few years into an executive management position with Airbnb. His is a very intriguing story of how he came into… Continue reading Be Part of the “Modern Elder” Movement

Extend Your Healthy Longevity – Twelve Things That May Be Accelerating Your Aging – A Three-part Series.

Image by Gerd Altmann from Pixabay “Life is a fatal disease. Once contracted, there is no known cure.” This is a quote from Dr. Walter Bortz, one of my favorite authorities on maintaining good health in our third age. Dr. Bortz is an 89-year old former Stanford University geriatric physician and author of seven books, my favorites being… Continue reading Extend Your Healthy Longevity – Twelve Things That May Be Accelerating Your Aging – A Three-part Series.

Are You “Winging It” Into Your Retirement?

“You’d Be Better Off Just Blowing Your Money: Why Retirement Planning Is Doomed.” This intriguing statement headlined an article that came through on my LinkedIn feed this week. I was shocked when I saw the source – Forbes.com! Surely, with that headline, this is coming from some rogue, off-the-edge, iconoclastic, contrarian writer looking to gain… Continue reading Are You “Winging It” Into Your Retirement?